Kraken Robotics Deep Dive

Kraken ($KRKNF | $PNG.V): The Enabling Public Supplier Beneath Anduril’s Undersea Autonomy Stack

Introduction

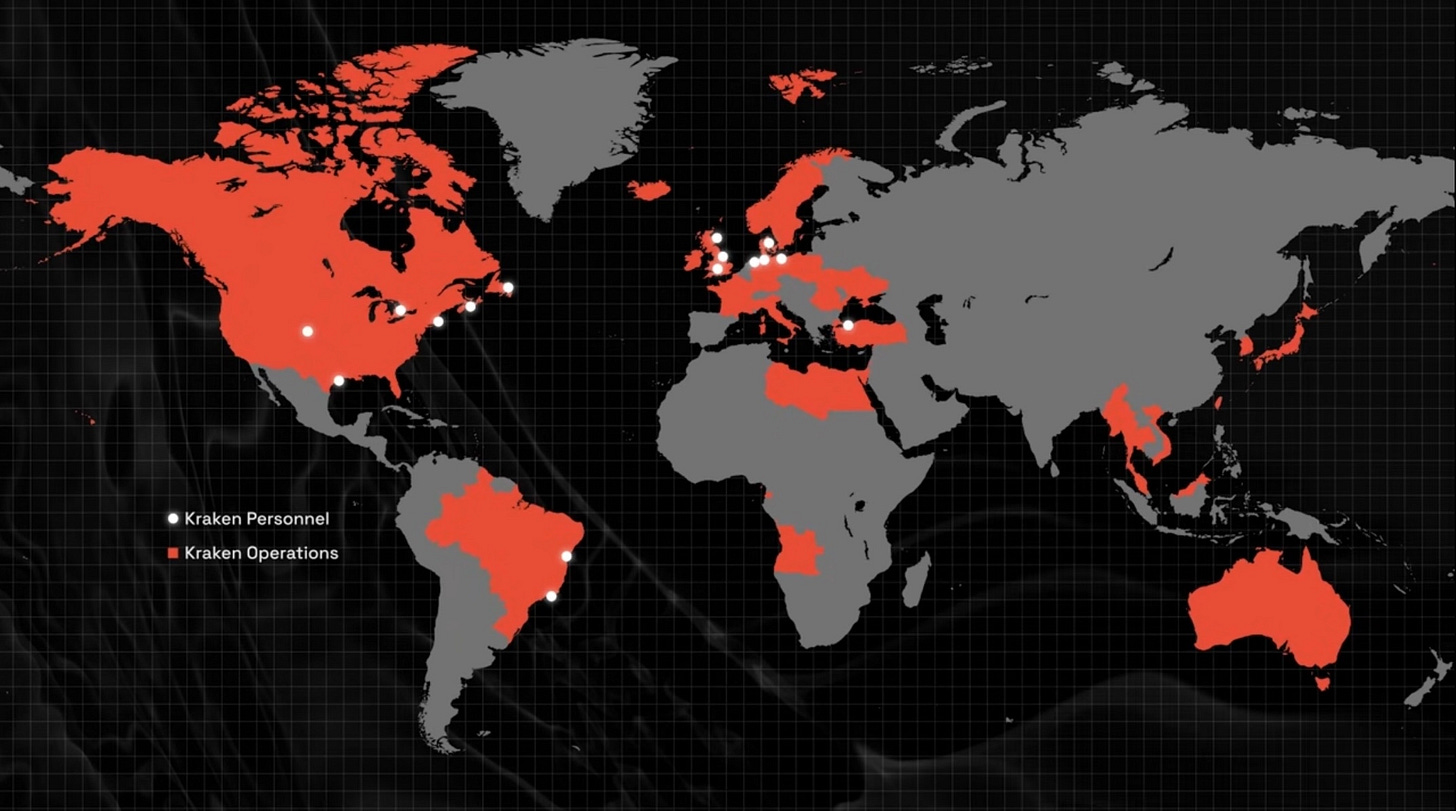

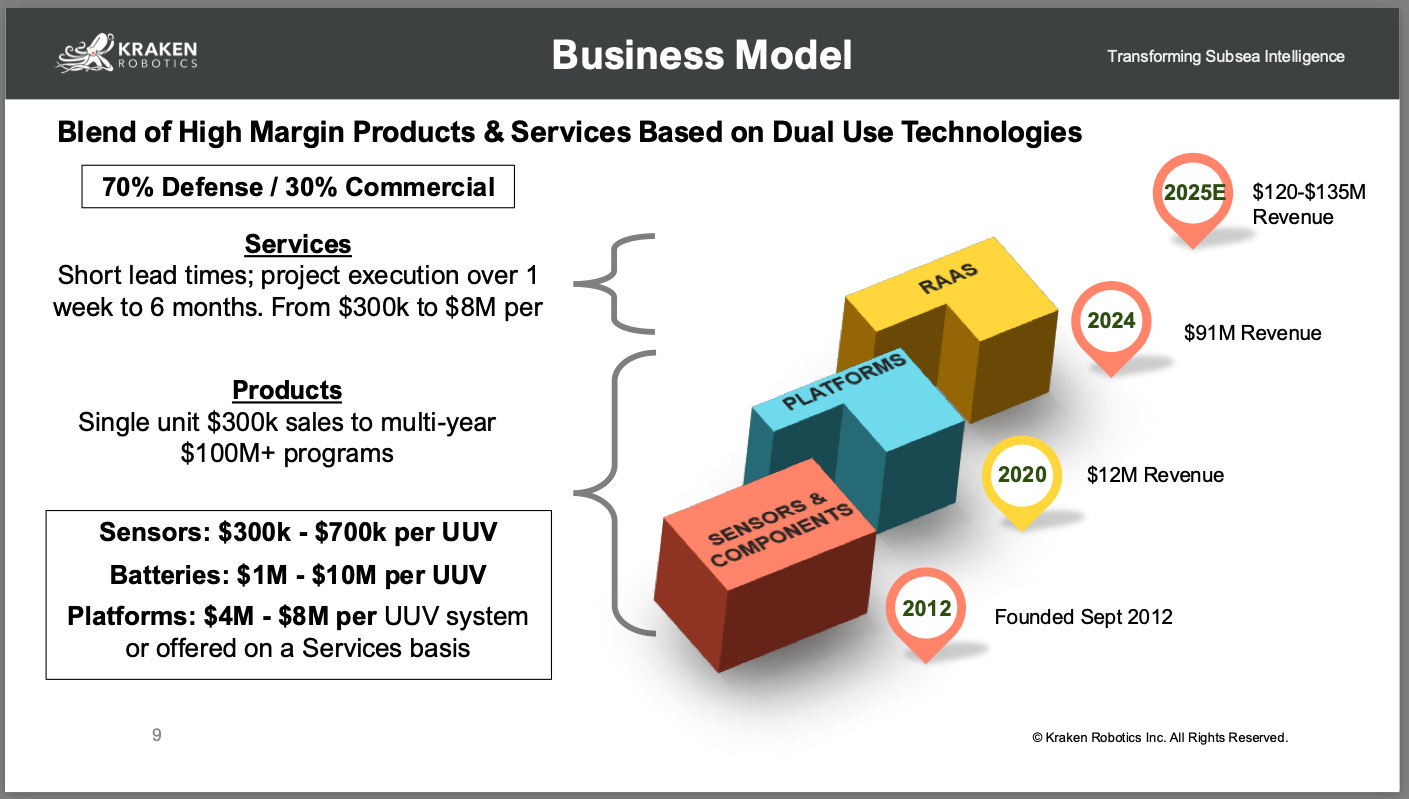

Kraken Robotics is emerging as a core infrastructure supplier to the new undersea order being built by the United States, its allies, and major offshore energy operators. It is not attempting to become a prime contractor or a platform integrator like Anduril or Kongsberg. Instead, Kraken occupies the more durable position beneath them: the enabling layer of pressure tolerant power, high resolution sensing, and subsea data infrastructure that allows next generation unmanned underwater vehicles (UUVs) and resident seabed systems to function at scale.

The company now sits at the convergence of three powerful structural forces.

First, a global undersea re-armament cycle is underway. China’s rapid naval expansion, intensifying competition over seabed infrastructure, and explicit allied targets to deploy large fleets of autonomous systems (particularly ahead of US Navy readiness milestones later this decade) are driving sustained demand for scalable, unmanned subsea capabilities.

Second, Kraken holds a leading position in two technological bottlenecks that directly constrain this build out. Its SeaPower™ pressure tolerant battery modules enable long duration operations at depths up to 6,000m, with emerging smaller and medium form factors expanding the addressable platform base. In parallel, Kraken has built one of the most comprehensive high resolution synthetic aperture sonar portfolios in the market, spanning towed systems (KATFISH™), modular AUV mounted SAS, sub-bottom imaging, and a potential circular SAS product designed to meet explicit US Navy requirements for omnidirectional sensing on autonomous platforms.

Third, Kraken has paired this technology stack with a business model optimized for capital efficiency and margin expansion. The company converts proprietary hardware and software into high margin product sales and recurring services, supported by capital light manufacturing, strong cash conversion, and incremental returns on invested capital from targeted capacity expansions such as the Halifax battery facility.

Within the thesis, Anduril is the dominant near and medium term growth driver. Kraken supplies critical subsystems across Anduril’s entire subsea portfolio (including Dive-LD, Ghost Shark (Dive-XL), Copperhead, and Seabed Sentry), making it structurally levered to Anduril’s scale up without bearing prime level program or balance sheet risk. At the same time, Kraken continues to diversify across other primes and operators, including HII/Hydroid, Kongsberg, multiple allied navies, offshore energy customers, and resident subsea systems via Verlume, reducing long term customer concentration risk.

The result is a company characterized by:

Defensible, high value niches in which Kraken is frequently sole sourced or specified by name, particularly in 6,000m pressure tolerant batteries and high end SAS for defense UUVs and towed systems.

A validated financial trajectory, with revenue scaling and analyst forecasts pointing to continued growth through 2027 alongside expanding EBITDA margins.

Multiple independent growth vectors, including Dive-LD and Ghost Shark volume ramps, additional XL-UUV platforms, Copperhead and Seabed Sentry scaling, REMUS/Lionfish upgrades, Verlume resident power systems, 3D at Depth LiDAR and RaaS, rising Canadian and NATO defense spending, and medium term TSX and NASDAQ uplisting optionality.

Despite this evolution, the market continues to largely price Kraken as a niche sonar and survey company. The reality is that Kraken has become a strategically relevant node in allied undersea infrastructure, with US procurement access through 3D at Depth and ITAR compliance, board level prime contractor expertise, and manufacturing capacity aligned with Anduril and broader NATO objectives.

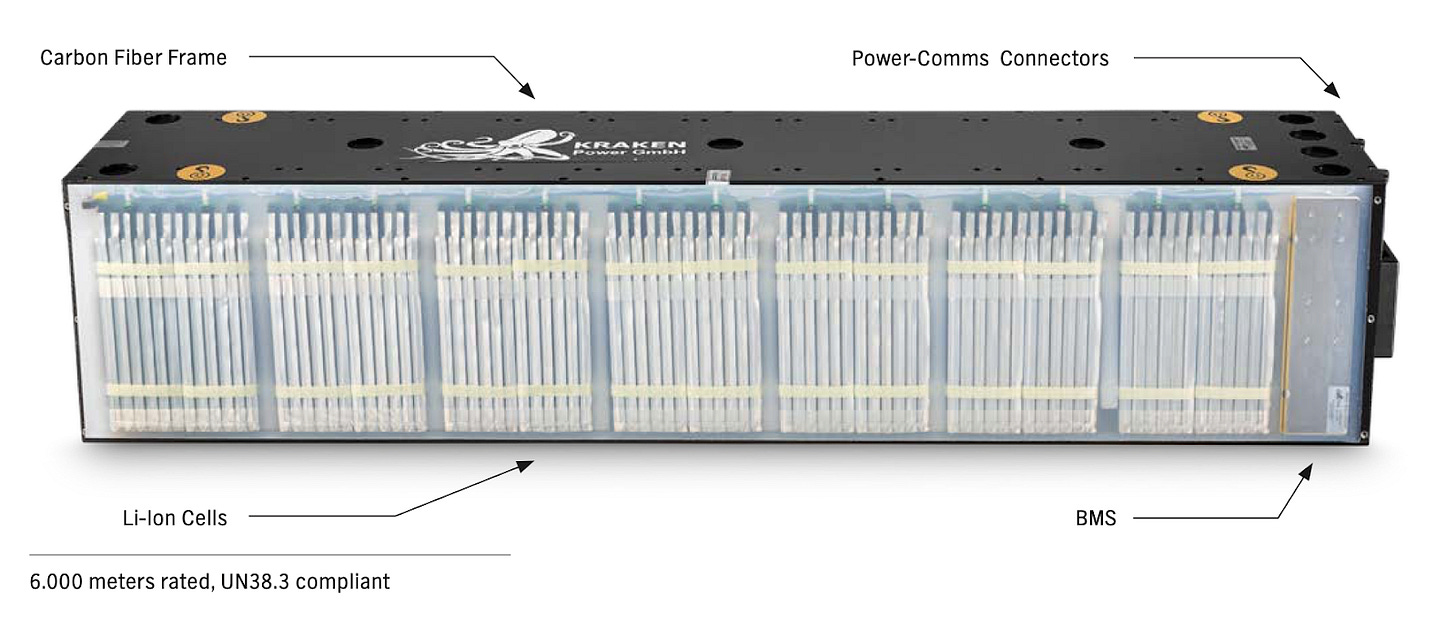

SeaPower™ Subsea Batteries

Kraken’s SeaPower™ platform is the foundational technology underpinning the company’s strategic position across autonomous undersea vehicles, seabed systems, and resident power architectures. Unlike most incumbent subsea battery solutions, SeaPower is designed around a pressure tolerant, polymer encapsulated architecture, eliminating the need for oil filled housings or titanium pressure vessels. This design choice drives a structural advantage across energy density, system weight, scalability, and operational simplicity.

Core Technical Characteristics

SeaPower batteries are certified for deep ocean operations and optimized specifically for autonomous and resident subsea systems:

Depth rating: certified to 6,000m (pressure neutral architecture scales beyond certification threshold)

Energy density: materially higher than oil filled and pressure vessel competitors at depth

Module sizes: up to ~23 kWh per module, stackable into multi-MWh banks

Architecture: silicone polymer encapsulation (no oil, no metal pressure housing)

Thermal and pressure behavior: inherently pressure balanced, eliminating mechanical stress points

This allows Kraken’s batteries to deliver more usable energy per unit of weight and volume, particularly at full ocean depth where competing solutions experience compounding efficiency penalties.

Competitive Performance vs. Alternatives

Relative to legacy subsea battery approaches (oil compensated steel canisters, titanium pressure vessels, gel filled designs), SeaPower offers a materially different performance profile:

Higher Wh/kg and Wh/L at operating depth

Lower in water mass for equivalent energy output

Fewer mechanical components and failure modes

Faster turnaround and simpler field servicing

Easier integration into AUV hulls and seabed pods

These advantages translate directly into longer mission endurance, greater payload flexibility, and lower system level cost for vehicle OEMs and navies.

Modularity and System Integration

SeaPower is designed as a platform, not a single battery SKU. Modules can be configured across voltage ranges and stacked to support:

Small and medium AUVs

XLUUVs and long endurance platforms

Seabed sentry nodes and resident power systems

Subsea microgrids and recharge stations

The batteries integrate with Kraken’s power management, communications, and rail systems, allowing customers to deploy standardized energy blocks across multiple vehicle classes rather than redesigning power systems per platform.

Intellectual Property Strategy and Barriers to Entry

While SeaPower is technically patentable, Kraken has not prioritized patent filings around the core encapsulation and system architecture. The rationale is pragmatic: patenting would require disclosing manufacturing processes and material formulations that currently remain proprietary.

Instead, Kraken’s moat is maintained through:

Process know-how that is difficult to reverse engineer

Years of pressure testing, qualification, and field deployment

Customer trust and certification history with defence and subsea operators

This is not technology that can be copied via public data sheets or incremental R&D spend. New entrants face multi-year timelines to reach equivalent performance, certification, and customer acceptance, particularly in defense applications where reliability thresholds are unforgiving.

Forward Development

Kraken is actively developing new SeaPower form factors targeted at:

Weapons class and torpedo diameter systems

Compact seabed nodes such as Seabed Sentry

Higher density variants optimized for resident operations

These next generation designs extend the same architectural advantages into smaller and more numerous platforms, aligning directly with Anduril’s Copperhead and seabed system roadmap.

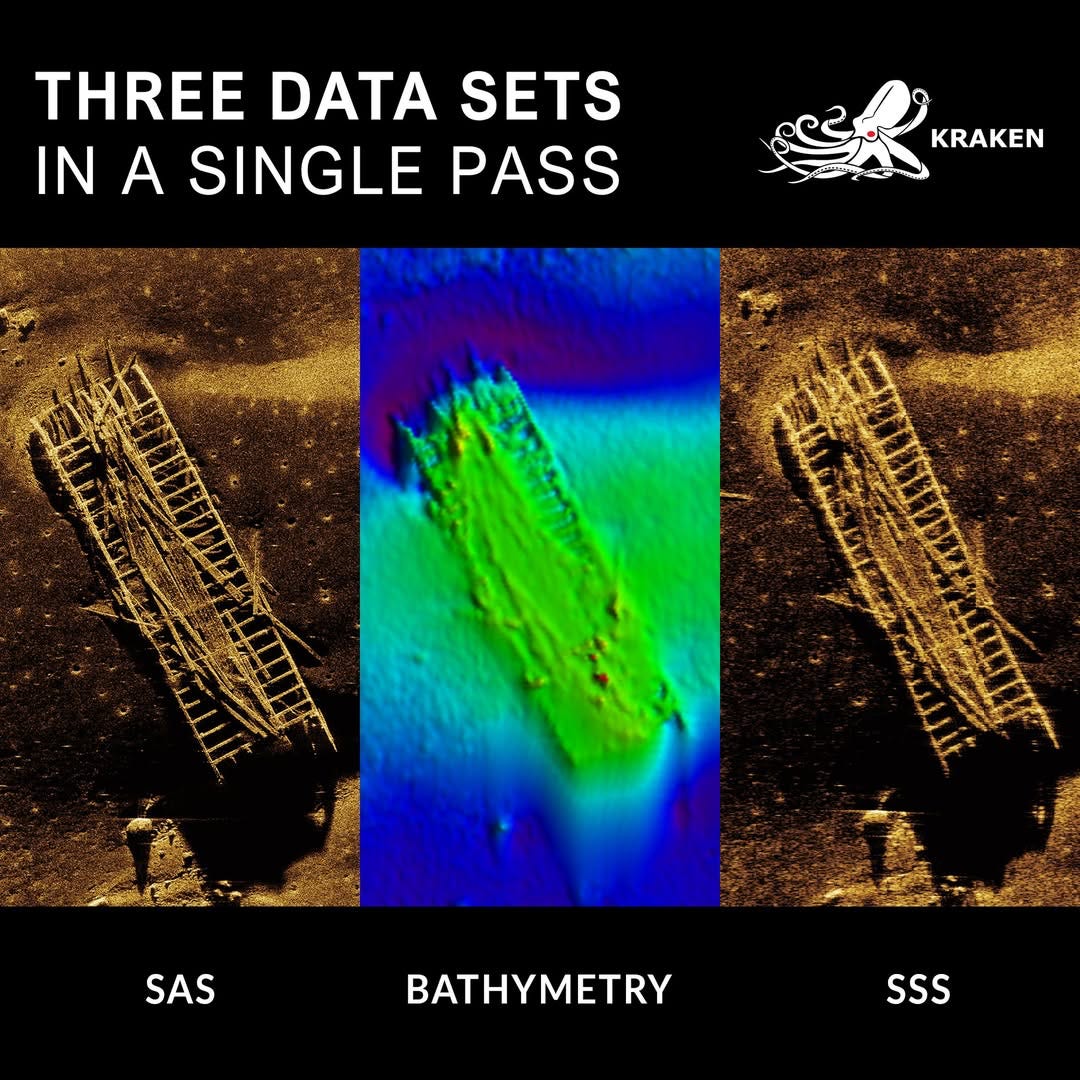

Synthetic Aperture Sonar (SAS)

Kraken’s Synthetic Aperture Sonar (SAS) sits alongside SeaPower as the Company’s second core bottleneck technology. Where SeaPower enables endurance and persistence, SAS enables decision quality perception, turning raw seabed data into actionable intelligence across military, security, and critical infrastructure missions.

Kraken SAS is not a marginal improvement over conventional side scan sonar, it’s a step change in how underwater environments are mapped, monitored, and contested. By performing high resolution imaging and bathymetric mapping simultaneously, Kraken SAS delivers consistent, survey grade data at ranges and speeds that materially reduce mission time and cost.

Core mission applications include:

Port and harbour security and clearance

Mine countermeasures (MCM)

Long term subsea and seabed monitoring

Covert and clandestine surveys (including LiDAR enabled workflows)

Inspection of cables, pipelines, and critical underwater infrastructure

For modern naval autonomy, SAS is rapidly becoming essential. The navies that matter are no longer asking whether they need SAS, but how fast they can deploy it across fleets of UUVs.

Technical Performance

Kraken’s SAS differentiates on a combination of resolution consistency, area coverage rate, and platform flexibility, a trio that is difficult to achieve simultaneously.

Key characteristics:

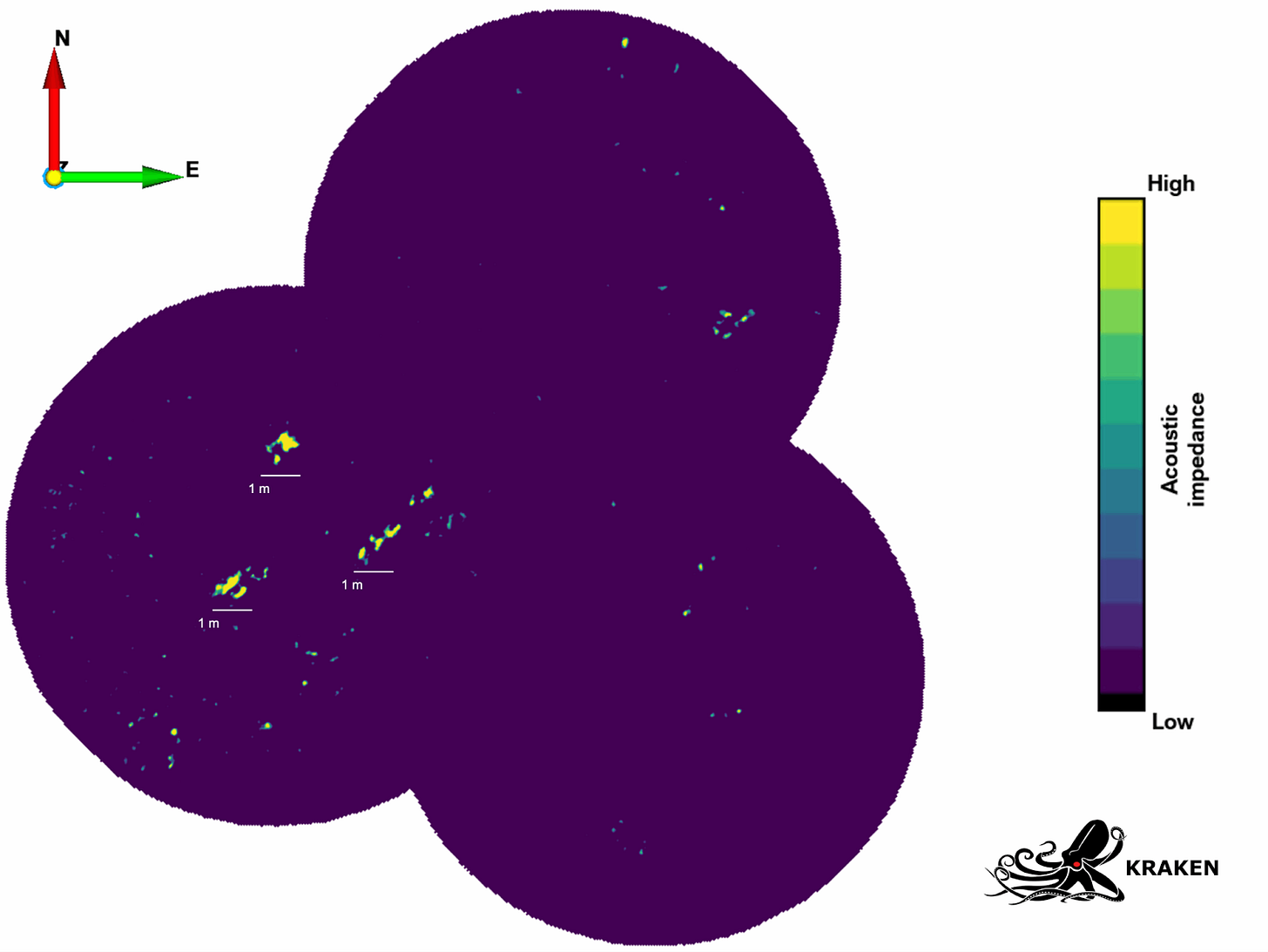

Constant resolution across the full swath, rather than degrading with range

Real time SAS resolution of ~3cm x 3cm, improving to ~2cm x 2cm post processing

Simultaneous bathymetry and dynamically focused sidescan, eliminating the need for separate survey passes

Ranges up to ~200m per side, enabling materially higher area coverage rates

Real time full swath processing, enabling embedded automatic target recognition (ATR) and autonomy features

Operationally, this translates into 2-3x reductions in mission duration versus traditional side scan sonar for comparable outcomes, an advantage that compounds quickly when operating autonomous fleets at scale.

Modular Design

One of Kraken’s underappreciated advantages is that its SAS is designed as a modular payload, not a bespoke one off sensor. The same core SAS technology can be deployed across:

Man portable systems (MP-SAS)

Small, medium, and large class UUVs

OEM or flood system configurations

Shallow water to full ocean depth missions (300m to 6,000m rated options)

This modularity has two important implications:

Kraken is rarely displaced once integrated. Switching costs are high once vehicle control, autonomy, and data pipelines are tuned around a specific SAS.

Kraken scales with its customers. As primes move from prototypes to production fleets, Kraken rides that curve without redesigning its core technology.

Real World Validation

Kraken’s SAS is not a lab grade solution searching for relevance, it’s repeatedly validated in multinational operational settings.

At the 2025 REPMUS exercise in Portugal, a record number of participants deployed Kraken SAS:

10 teams across 7 navies and 3 UUV manufacturers

Integrated across four different UUV classes, from small to large

Used for mine countermeasures, maritime security, and infrastructure inspection

Achieved consistent detection of mine like objects and subsea cables as small as ~5cm diameter at constant resolution

This marked Kraken’s fourth consecutive year supporting REPMUS, with usage growing from a single team in 2022 to double digit adoption in 2025. Importantly, Kraken personnel supported shore side integration and live data exploitation, reinforcing Kraken’s role not just as a hardware vendor, but as a mission enabling partner.

REPMUS is effectively a proving ground for future NATO procurement. Technologies that perform here tend to propagate into formal requirements, and Kraken SAS is now firmly embedded in that ecosystem.

Competitive Positioning and Barriers to Entry

SAS is not “copy and paste” sonar. Achieving Kraken level performance requires:

Precise motion compensation and vehicle stability handling

Advanced signal processing and real time compute integration

Deep domain knowledge in acoustics, autonomy, and underwater navigation

Years of operational feedback loops with real navies and operators

This is why the SAS competitive field is narrow, and why Kraken is repeatedly selected across platforms and primes. Much like SeaPower, Kraken’s SAS benefits from cumulative engineering advantage, each deployment improves the product, while making it harder for new entrants to catch up.

Kraken’s SAS portfolio reinforces the same strategic pattern seen in batteries: high performance subsystems that become de facto standards inside much larger defense and autonomy programs, with long product lifecycles and embedded customer relationships.

Kraken’s competitive position in SAS is further reinforced by an existing portfolio of granted and pending patents covering elements of synthetic aperture processing, sonar architectures, and data handling workflows. While Kraken does not aggressively foreground its IP strategy, this is deliberate rather than indicative of weakness. In several core areas (motion compensation, real time SAS processing, and system level integration) Kraken’s advantage comes from tightly coupled hardware and software know-how that is difficult to reverse engineer and even harder to replicate without years of operational data.

Management has been explicit that over-patenting would risk disclosing proprietary methods to competitors, especially in a field where practical execution matters more than abstract claims. As a result, Kraken selectively patents where defensible while continuing to advance next generation SAS variants (including higher coverage and circular configurations) that extend the performance gap and reset the benchmark before competitors can respond.

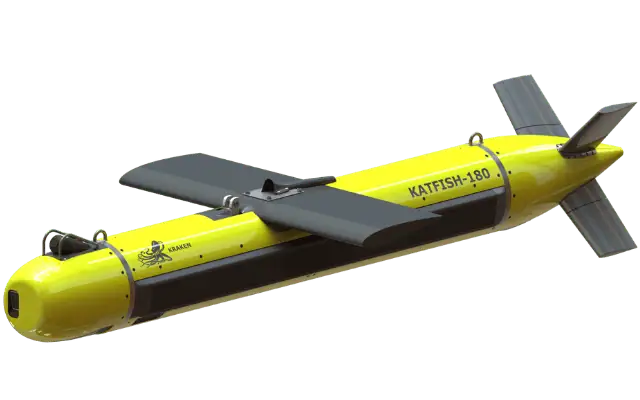

KATFISH: Towed SAS, RaaS, and Scalable Maritime Intelligence

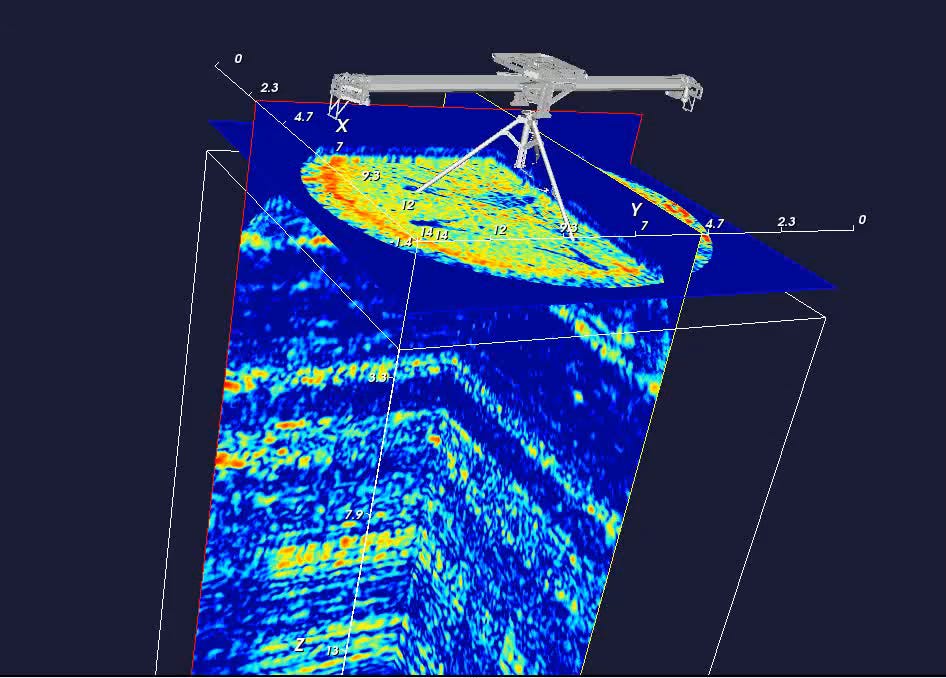

KATFISH is Kraken’s modular, tow body synthetic aperture sonar system designed for rapid, high resolution seabed mapping and mine countermeasure operations from both crewed and uncrewed surface vessels. Where Kraken’s UUV mounted SAS addresses autonomous undersea platforms, KATFISH extends the same core imaging advantage to surface deployed missions, significantly broadening Kraken’s addressable market across naval, commercial, and hybrid government-commercial users.

At a technical level, KATFISH leverages the same SAS signal processing, resolution, and classification strengths as Kraken’s vehicle mounted systems, but packaged into a towed form factor that is faster to deploy, easier to maintain, and operationally flexible. This makes it particularly attractive for customers who require high end seabed intelligence without the complexity, certification burden, or cost of operating large AUV fleets.

Operational Role and Mission Fit

KATFISH is optimized for missions where persistence, speed of coverage, and data quality matter more than full autonomy:

Mine countermeasures (MCM) and route survey

Port, harbour, and choke point security

Critical subsea infrastructure inspection (cables, pipelines, seabed installations)

Rapid response survey following geopolitical or environmental events

Because KATFISH is towed from a surface vessel, it can be deployed continuously for long durations, swapped between platforms, and operated by smaller crews, making it well suited to both naval forces with constrained budgets and commercial operators working under time critical contracts.

RaaS (Robotics-as-a-Service)

KATFISH is a central pillar of Kraken’s Robotics-as-a-Service (RaaS) strategy. Rather than being sold exclusively as a one off hardware system, KATFISH is frequently deployed as part of recurring service contracts where Kraken retains ownership of the system and monetizes:

Survey campaigns

Multi-year monitoring programs

Data processing, interpretation, and delivery

This model has several important implications:

It lowers the upfront cost for customers, accelerating adoption.

It generates recurring, high margin revenue for Kraken rather than one time hardware sales.

It creates a feedback loop where operational data directly informs product improvements, a dynamic management has previously described as “eating our own cooking.”

In commercial offshore energy, seabed monitoring, and government sponsored mapping programs, this RaaS approach allows Kraken to compete not just as a hardware vendor, but as a long term intelligence partner embedded in customer workflows.

Launch and Recovery as a Competitive Bottleneck: LARS

A critical enabler for KATFISH (especially from uncrewed surface vessels) is Kraken’s Launch and Recovery System (LARS). Launch and recovery is one of the highest risk phases of any towed or autonomous system deployment, and this risk compounds significantly when operating from USVs without human intervention.

Kraken’s USV optimized LARS directly addresses this bottleneck:

Fully autonomous launch and recovery from unmanned surface vessels

Intelligent winch control that actively manages tow cable tension and vessel motion

Safe operation in higher sea states and dynamic conditions

Titanium construction for strength, low weight, and low magnetic signature

By controlling both the sensor (KATFISH) and the mechanical interface (LARS), Kraken reduces integration risk for customers and delivers a turnkey solution that competitors often struggle to replicate. This vertical integration is particularly important as navies increasingly push toward unmanned surface-and-subsurface teaming concepts.

Competitive Positioning

While towed sonar systems are not new, KATFISH’s differentiation lies in the combination of:

True synthetic aperture resolution rather than conventional side scan

Operationally proven performance across multiple navies and exercises

Integration with autonomous and uncrewed surface platforms

A commercial delivery model that emphasizes recurring revenue and long term contracts

Replicating this capability is not simply a matter of building a tow body. It requires deep expertise in sonar physics, signal processing, mechanical design, hydrodynamics, launch and recovery engineering, and operational deployment. Capabilities that Kraken has built over more than a decade of real world use.

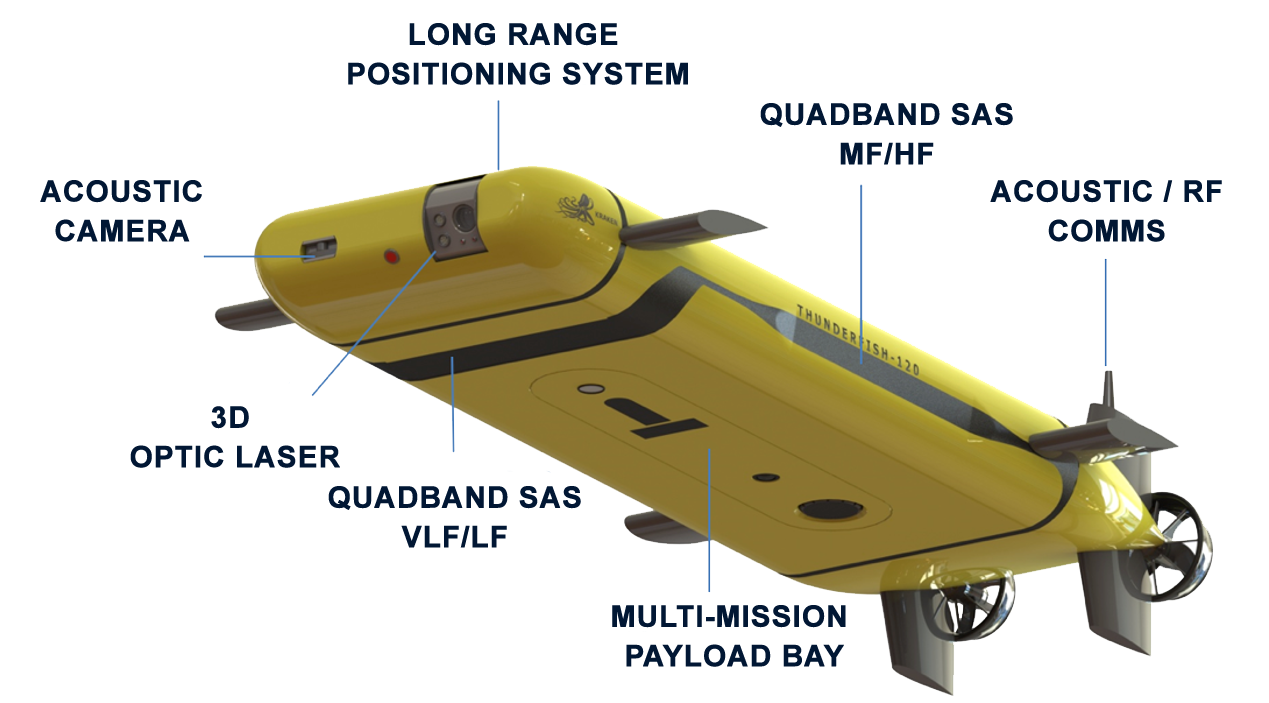

ThunderFish® XL

ThunderFish® XL, Kraken’s internally developed UUV, serves primarily as a platform to showcase and validate Kraken’s technology stack: batteries, SAS, and autonomy, in an integrated vehicle. While not a near term revenue driver, ThunderFish reinforces Kraken’s credibility as a full stack undersea robotics company and provides an internal testbed that directly benefits systems like KATFISH through shared software, processing, and operational learnings.

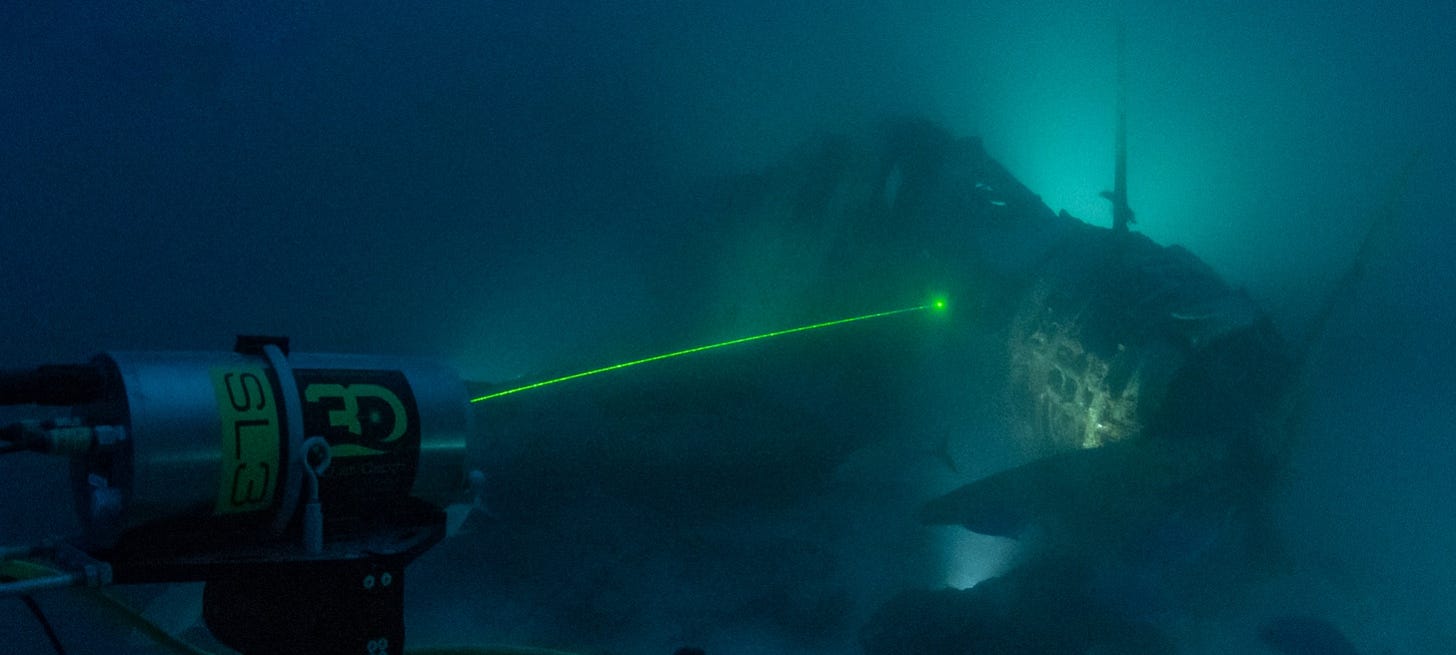

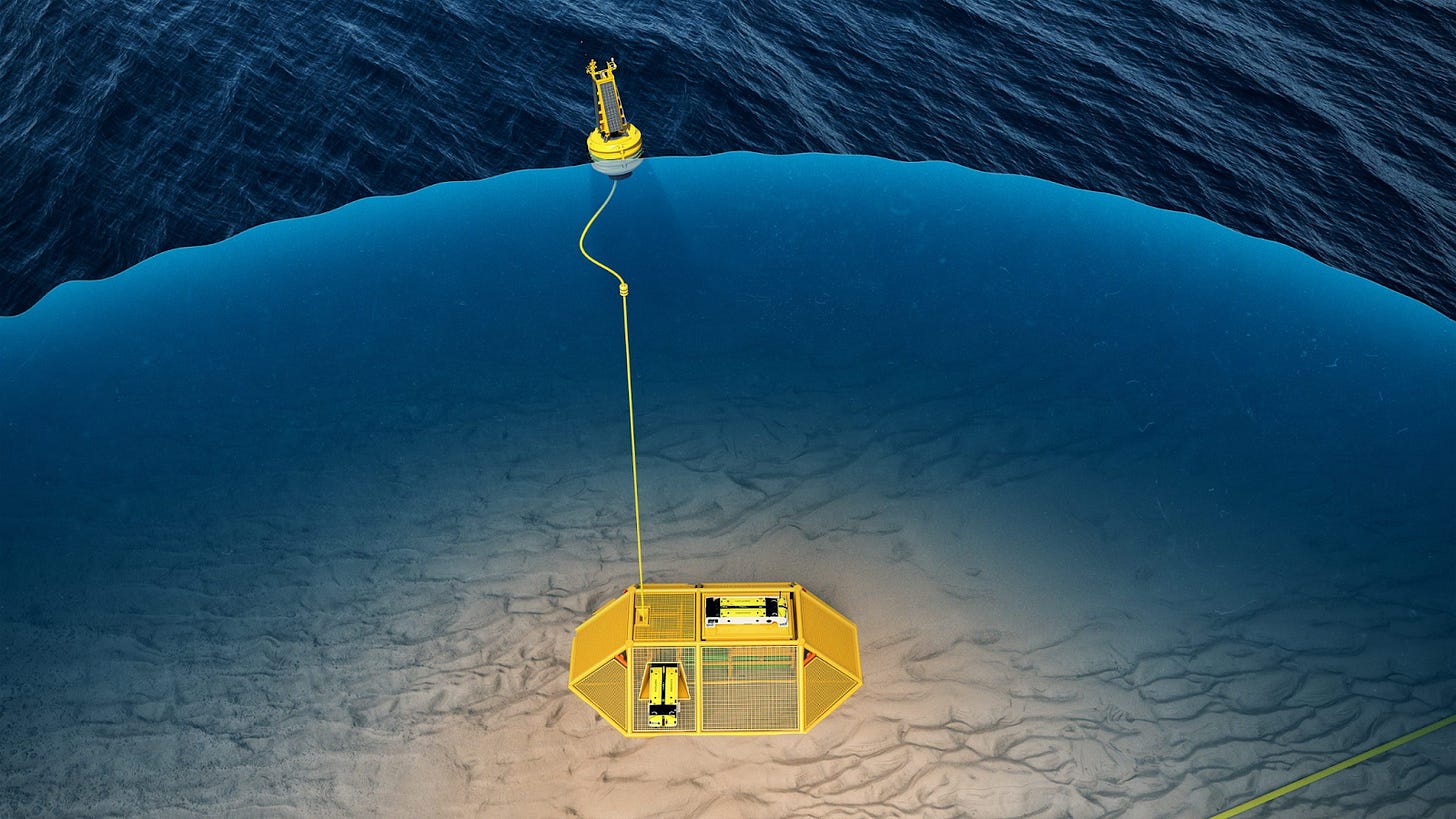

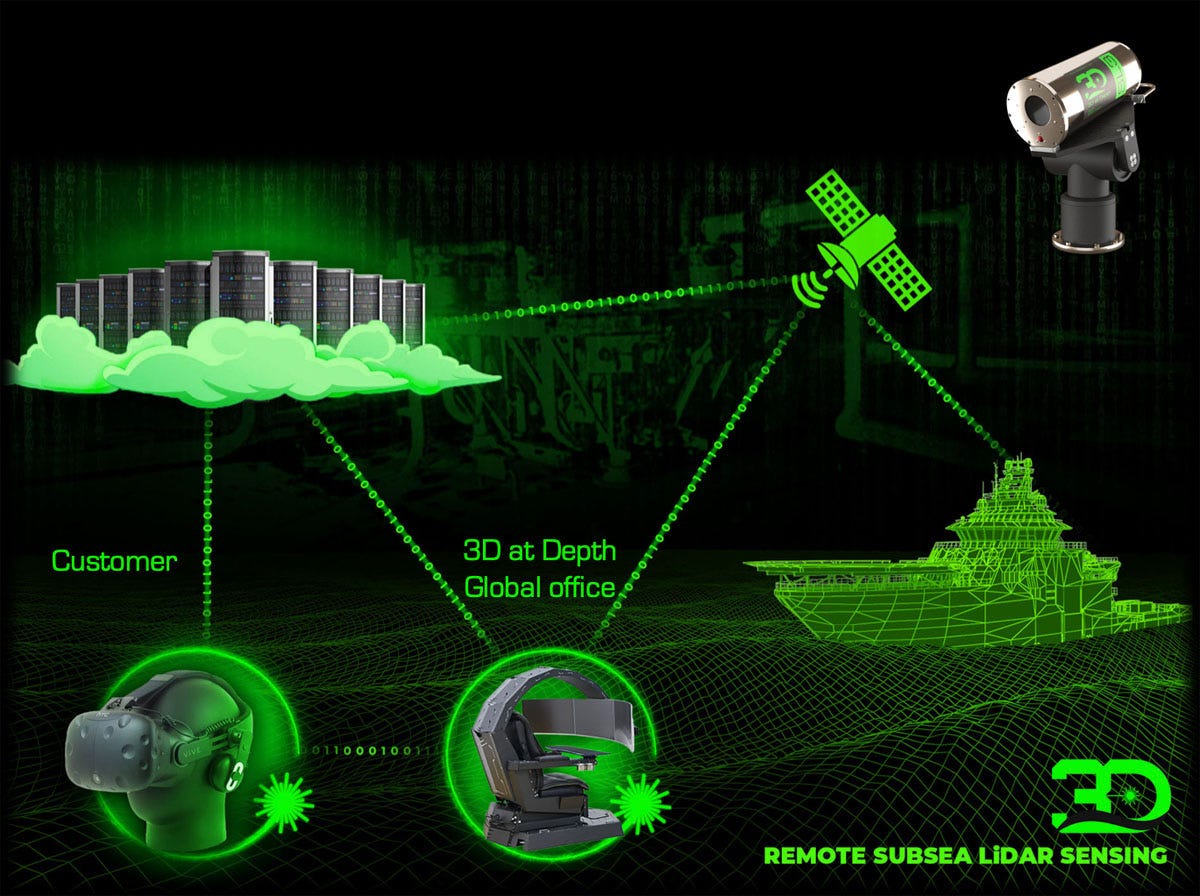

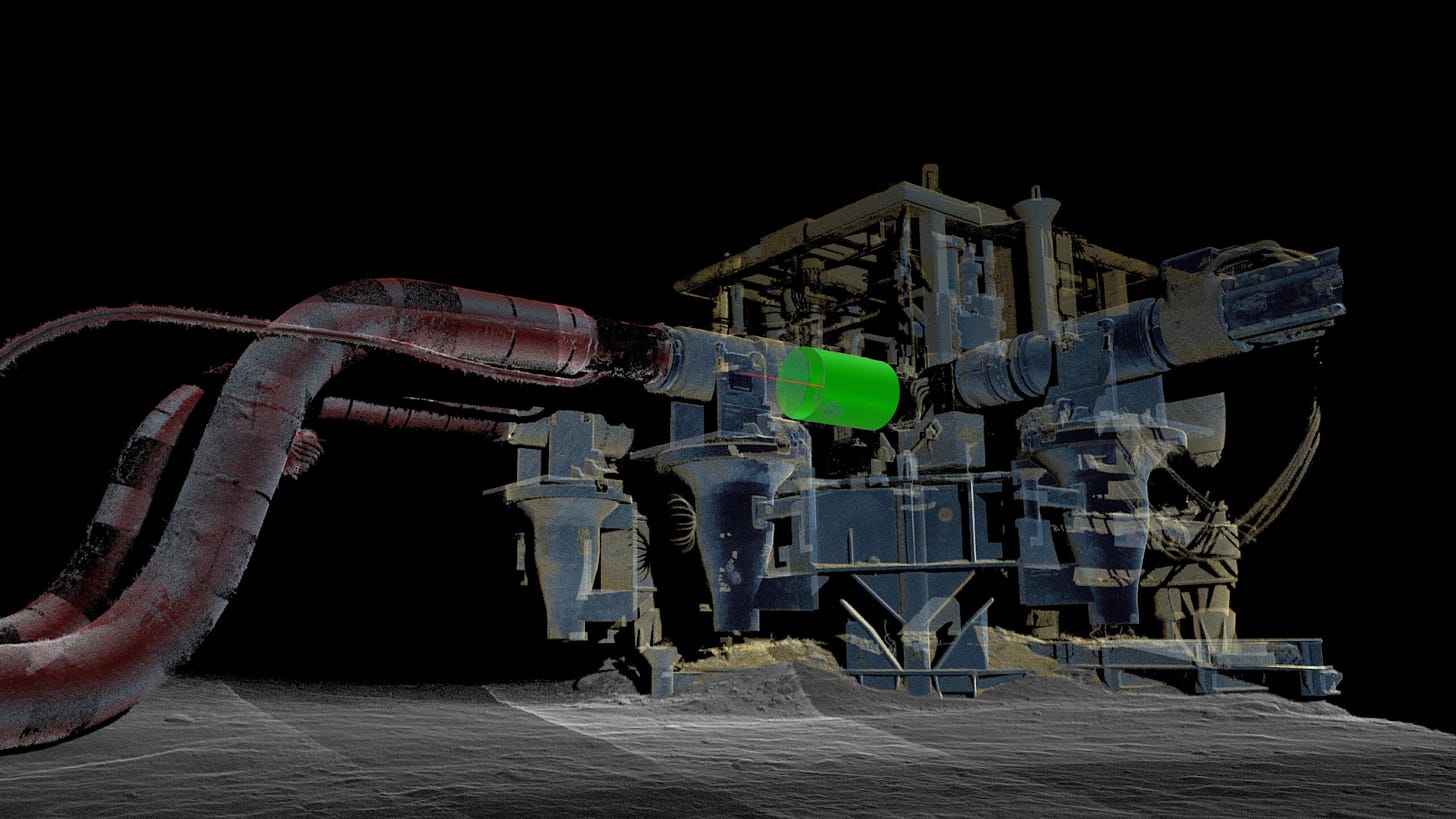

Subsea LiDAR (3D at Depth)

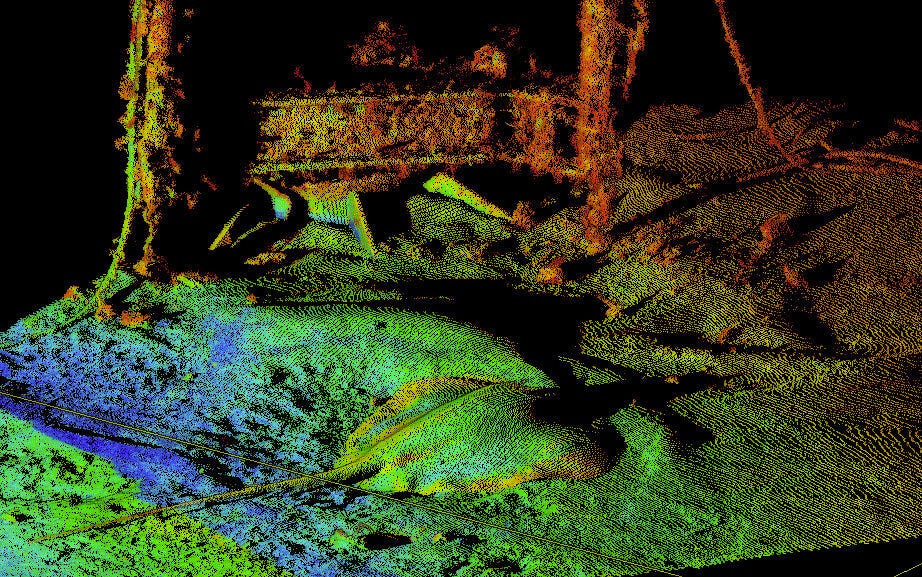

Kraken’s Subsea LiDAR capability, delivered through its 3D at Depth division, represents the highest fidelity underwater reality capture technology currently deployed at scale. It is a fundamentally different sensing modality from sonar, enabling true optical, millimetric accuracy 3D measurement of submerged assets, structures, and environments where acoustic methods lack the required precision.

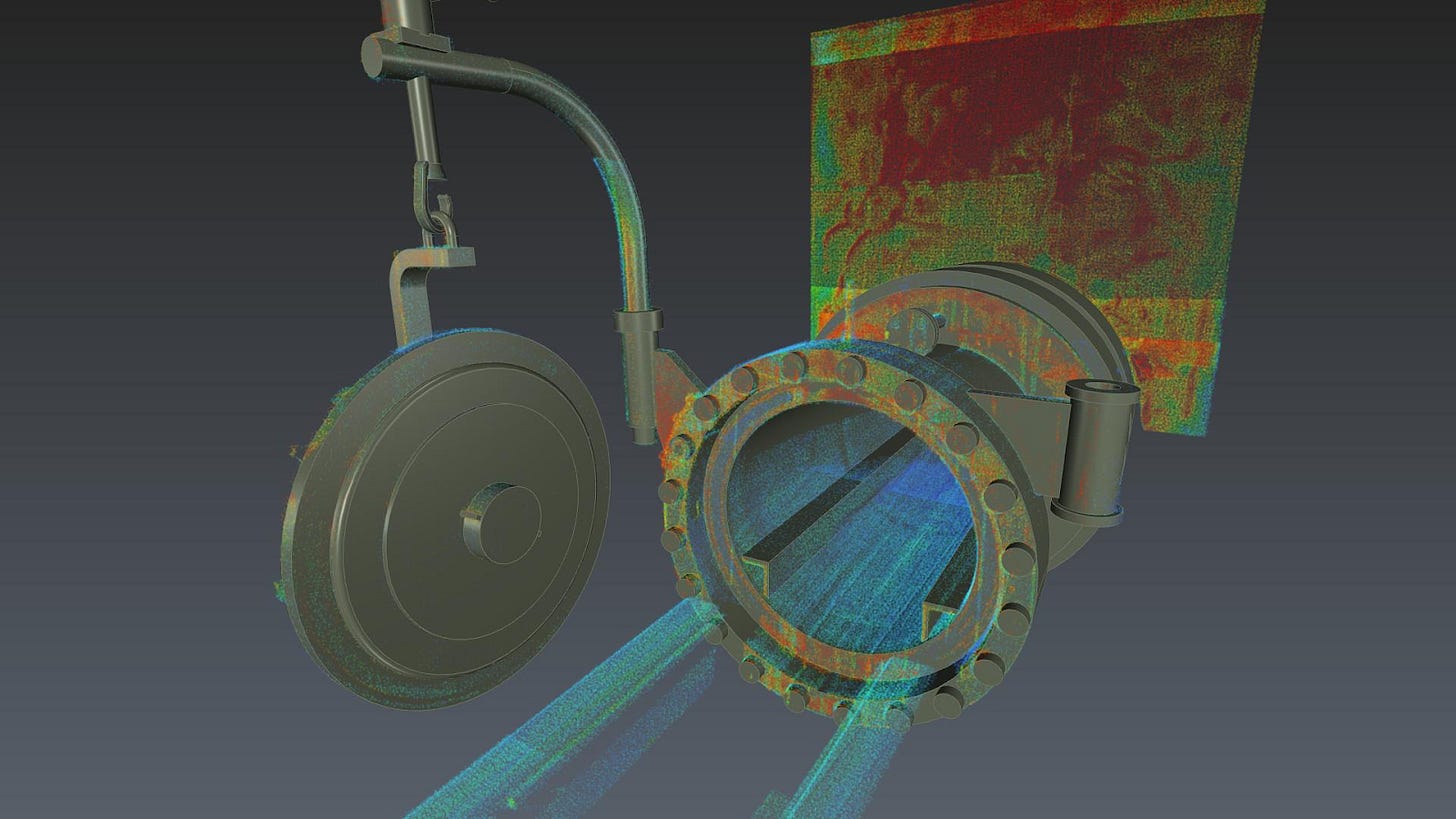

At its core, Kraken’s Subsea LiDAR uses time-of-flight pulsed laser technology to generate dense, engineering grade point clouds of underwater objects and infrastructure. The system operates contactlessly from standoff distances exceeding 10m, materially reducing operational risk while delivering accuracy sufficient for metrology, installation validation, and long term condition monitoring. Systems are rated to depths of up to 4,000m, operate in complete darkness without external lighting, and can be deployed from stationary frames, ROVs, AUVs, or pole mounted configurations.

Technical Differentiation

Kraken’s Subsea LiDAR is not positioned as a visual inspection tool, it’s an engineering measurement system. Key technical attributes include:

Millimetric precision: Single point range precision below 2.5mm and sub millimeter precision in aggregated measurements across operational ranges.

High density data capture: Up to ~14 million points per scan, enabling accurate reconstruction of complex geometries.

360° coverage: Pan tilt architectures provide full circumferential scanning, allowing complete asset capture without repositioning.

Operational robustness: Fully functional in bright sunlight or complete darkness, with performance independent of ambient lighting conditions.

Advanced data formats: Proprietary high efficiency point cloud formats alongside industry standards, enabling seamless integration into engineering workflows.

Core Applications and End Markets

Subsea LiDAR materially expands Kraken’s addressable market beyond survey into inspection, lifecycle management, and compliance driven monitoring, where data quality directly influences operational decisions and liability exposure.

Primary commercial and industrial use cases include:

Subsea metrology for spool pieces, jumpers, and tie-ins

Digital twin creation and as-built verification

Pipeline inspection, deformation tracking, and leak detection

Damage assessment and predictive maintenance

Decommissioning planning and verification

Offshore wind, oil & gas, and hydroelectric infrastructure inspection

In nuclear and high consequence environments, Kraken’s LiDAR provides a unique, defensible capability set. The company’s patented Nuclear LiDAR systems enable near real time inspection of submerged and above water nuclear assets without physical contact or custom mechanical tooling.

Applications include:

Reactor vessel and core alignment verification

Foreign object detection and debris identification

Below-core-plate inspections

VT-1 / VT-3 compliant inspections

Change detection and long term condition monitoring

In these environments, traditional visual inspections are often infeasible, slow, or operationally risky. Kraken’s LiDAR materially reduces outage duration, improves safety margins, and enables data driven maintenance planning. Outcomes that are valued far in excess of the cost of the inspection itself.

Integrated Measurement and Digital Twin Workflow

A critical, often underappreciated advantage of Kraken’s LiDAR offering is its integration into full dimensional control and CAD workflows. By combining subsea LiDAR data with terrestrial laser scans through shared registration targets, Kraken produces unified, high accuracy digital twins that bridge the surface-subsea boundary.

This integrated approach enables:

Inferred measurements where direct access is impossible

Alignment of subsea assets with topside reference frames

Early detection of installation errors before irreversible commits

Reduction in rework, downtime, and project risk

This capability is particularly valuable in offshore energy and nuclear applications, where installation errors carry multi-million-dollar consequences.

Strategic Role

Subsea LiDAR strengthens Kraken’s business model in three structurally important ways:

High margin services revenue: LiDAR deployments are often delivered as full service projects with attractive margins and repeat work driven by inspection cycles.

Procurement leverage: Through 3D at Depth, Kraken operates as a US based, ITAR compliant supplier with established MSAs, simplifying access to regulated customers.

Data moat: Longitudinal LiDAR datasets create switching costs, as customers increasingly rely on historical point clouds for change detection and asset management.

While Subsea LiDAR is not the primary driver of near term defense upside, it materially enhances Kraken’s commercial durability, margin profile, and strategic relevance across offshore energy, infrastructure, and nuclear markets. It also reinforces Kraken’s broader positioning as a company that does not merely sense the underwater domain, but measures it to engineering standards.

Acoustic Coring (AC)

Kraken’s Acoustic Corer (AC) represents a structurally differentiated approach to sub-seabed characterization, purpose-built for applications where traditional towed 2D/3D seismic systems fail to deliver sufficient resolution, positional accuracy, or cost efficiency. The system is designed to resolve cobbles and boulders as small as ~0.2 m in diameter, while simultaneously penetrating up to ~30 meters below the seabed, a capability set that directly addresses offshore wind, subsea infrastructure, and defense engineering constraints.

System Architecture

Unlike conventional seismic methods, Kraken’s AC employs a multi-frequency, multi-source acoustic approach, combining:

High frequency chirp (HF) for near surface resolution

Low frequency chirp (LF) for deeper sediment penetration

Innomar chirp sources to enhance signal clarity and geological discrimination

Each scan location consists of a triple acoustic core, with:

Three ~12m diameter acoustic cores

Collected in a triangular pattern

Laterally and vertically aligned

Merged into a single, continuous 3D acoustic volume with no offset artifacts

This architecture allows Kraken to deliver true volumetric sub seabed imaging, rather than interpolated or probabilistic interpretations common in legacy systems.

Performance Outcomes vs Legacy Seismic

Case study deployments demonstrate clear advantages over competing 3D acoustic systems:

Resolution sufficient to identify sub-seabed boulders ≥0.2 m

Reliable penetration through coarse sands and heterogeneous sediments

Significantly improved anomaly clarity compared to other 3D acoustic datasets

Ability to operate effectively in geologically challenging seabed conditions where prior surveys failed

In the Gennaker Offshore Substation (OSS) project, Kraken’s AC identified 1,057 discrete acoustic anomalies across 24 scan locations, enabling precise foundation design and avoidance strategies that were not possible using prior seismic data.

Engineering, Cost, and Schedule Advantages

From an operator and developer perspective, AC is not just higher resolution, it’s economically and operationally superior:

Enables pin pile and foundation designs that account for exact geological conditions

Allows micro siting adjustments (Ex: rotating OSS footprints within the 3D dataset) to avoid installation risk

Reduces the probability of costly offshore surprises during construction

Compresses survey timelines relative to large scale seismic campaigns

Lowers total project risk and commercial exposure for EPCs and developers

This directly translates into cost and schedule savings, particularly in offshore wind and energy transition projects where seabed uncertainty is a primary source of overruns.

Strategic Role Within Kraken’s Portfolio

Acoustic Coring complements Kraken’s broader subsea intelligence stack:

Pairs naturally with Sub-Bottom Imaging (SBI) for layered geological understanding

Enhances offshore wind site characterization, cable routing, and foundation planning

Supports defense and infrastructure programs requiring high confidence sub-seabed intelligence

Fits seamlessly into Kraken’s survey-as-a-service and project based revenue model, rather than one off hardware sales

Critically, AC reinforces Kraken’s positioning not just as a hardware provider, but as a mission critical data and decision enabling platform for subsea environments where errors are disproportionately expensive.

Circular SAS (CSAS)

A key product evolution referenced earlier (but not yet formally announced) is Kraken’s Circular SAS (CSAS). This system is understood to re-architect Kraken’s SAS technology into a compact, 360 degree configuration, effectively wrapping a synthetic aperture array around a vehicle mast or hull to provide continuous, omni directional imaging.

This architecture delivers persistent situational awareness, mine and obstacle detection, and all around seabed imaging without requiring vehicle maneuvering. These capabilities are increasingly viewed as non-optional requirements for next generation mine countermeasures (MCM), harbor defense, and autonomous undersea operations.

While Kraken has not publicly released specifications, program level requirements and industry discussions strongly indicate that the US Navy and several allied navies are actively seeking a CSAS-type capability for emerging small and medium class UUV fleets. Importantly, US programs increasingly mandate domestic compliant architectures and ITAR aligned supply chains, which helps explain both the timing and strategic rationale for Kraken’s development work in this area.

From an economic standpoint, Circular SAS is expected to differ materially from Kraken’s existing large SAS arrays:

Likely smaller and more modular, with a lower per-unit ASP

Designed for high volume deployment rather than bespoke integration

Optimized for platforms where traditional side looking SAS is impractical

Potential deployment targets include:

MCM drones and expendable systems

Resident AUVs and seabed surveillance nodes

Weapons class UUVs

Autonomous surface vessels (USVs) requiring subsurface awareness

While per unit pricing is expected to be lower, the addressable platform count is meaningfully larger, implying that total revenue opportunity could exceed that of traditional SAS programs. In other words, CSAS trades ASP for platform density, expanding Kraken’s SAS TAM rather than cannibalizing it.

Given that a circular, omni directional SAS has been explicitly identified as a US Navy requirement, a future CSAS product announcement stands out as a credible near term catalyst, particularly as Kraken continues to deepen its US defense footprint and compliance posture.

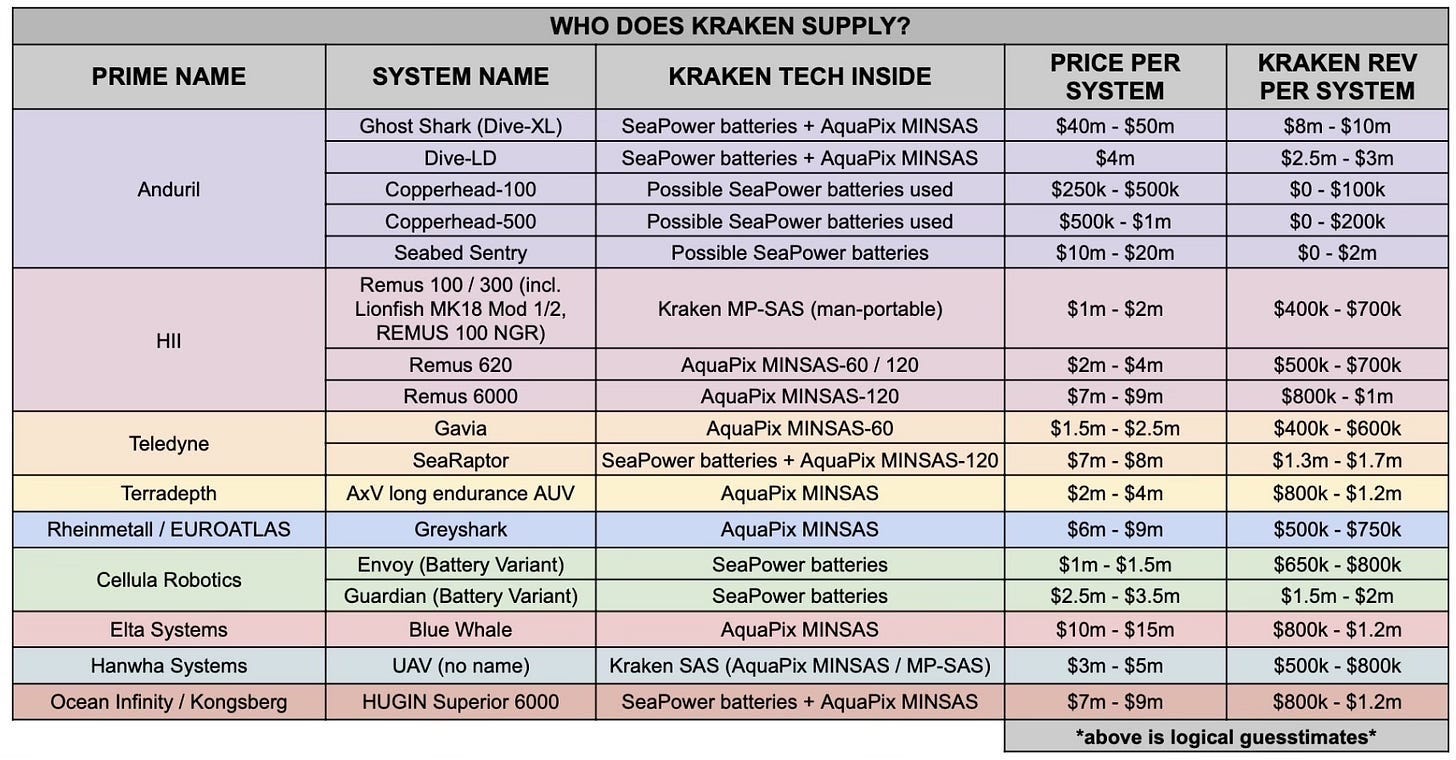

Strategic Programs and Platform Integration

Kraken’s defense business is built on their two bottleneck technologies, pressure tolerant SeaPower batteries and AquaPix® Synthetic Aperture Sonar (SAS). These subsystems are mission critical and increasingly show up across nearly all modern unmanned undersea platforms. Below is a table I’ve put together with all known tech Kraken supplies:

Anduril Industries: The Core Growth Engine

Anduril is Kraken’s largest, fastest scaling customer and the clear center of gravity for Kraken’s medium term revenue expansion. Across Anduril’s maritime portfolio, Kraken supplies mission critical subsystems (power and sensing) that directly determine endurance, autonomy, and lethality. These are not optional components, they’re enabling technologies without which the platforms cannot operate.

Kraken technology is integrated across every major Anduril undersea system: Dive-LD, Ghost Shark (Dive-XL), Copperhead (100M / 500M), and Seabed Sentry. Collectively, these programs are architected for hundreds to thousands of units per year, creating a scaling dynamic where Kraken captures value per platform while Anduril scales hull count.

Dive-LD

Dive-LD is the highest confidence revenue anchor in Kraken’s portfolio from 2025-2030. Following a competitive swim off in late 2023, the US Navy selected Anduril’s Dive-LD and subsequently awarded an US$18.6M contract alongside Replicator Tranche 2 designation, placing the platform at the center of the Pentagon’s accelerated autonomy roadmap.

Kraken content on each Dive-LD includes:

SeaPower pressure tolerant batteries, enabling deep water endurance without heavy pressure vessels

AquaPix® MIN-SAS, providing high resolution seabed and object detection

Integration electronics and supporting subsystems

In 2025, Anduril opened a ~150,000 sq. ft AUV production facility at Quonset Point, Rhode Island. Anduril explicitly stated that this facility enables immediate scaling of the Dive-LD family to more than 200 hulls per year, signaling intent to operate near nameplate capacity rather than treat the site as optional surge capacity.

Estimated Kraken revenue per Dive-LD:

US$2.5-3.0M per vehicle

At full-rate production:

US$500-600M per year of Kraken revenue if Anduril operates the facility as designed

Operationally, Dive-LD fills a critical role in:

Mine countermeasures (MCM)

ISR and seabed mapping

Forward deployed autonomous patrol

Contested littoral and deep water reconnaissance

Ghost Shark (Dive-XL)

Ghost Shark is Kraken’s largest confirmed international defense program and a flagship example of allied adoption. Australia awarded Anduril a A$1.7B contract to deliver “dozens” of Ghost Shark XL-AUVs to the Royal Australian Navy over five years.

Derived from Dive-XL, Ghost Shark integrates:

50-60 SeaPower battery modules per vehicle

AquaPix® SAS for wide area, high resolution sensing

Additional Kraken electronics and integration support

Estimated Kraken revenue per Ghost Shark:

US$10M per vehicle

For a conservative 40-vehicle fleet:

US$400M total Kraken revenue

US$80M per year over five years

Ghost Shark’s mission set includes:

Long range ISR

Anti-submarine warfare support

Persistent presence in denied waters

Force multiplication alongside crewed submarines

The scale, duration, and allied nature of this program materially de-risk Kraken’s international defense exposure.

Copperhead 100M & 500M

Copperhead is Anduril’s family of autonomous undersea weapons, designed to fundamentally disrupt legacy torpedo economics and production rates.

Variants include:

100M (12.75-inch): small torpedo / attritable autonomous weapon

500M (21-inch): large torpedo / long range autonomous strike platform

Anduril has stated its production system is designed for “very high hundreds to thousands of systems per year”, compared to legacy global torpedo production of roughly 100-200 units annually.

Kraken’s expected role:

Primary supplier of SeaPower torpedo class batteries

~50% probability of supplying a miniaturized AquaPix® SAS seeker on certain variants

Estimated Kraken revenue per unit:

100M: C$0-100k

500M: C$0-200k

Even conservative internal modeling:

2026: ~C$30-40M

2027: ~C$75-100M+ under modest scaling

Longer term, Copperhead represents a structurally large opportunity as autonomous weapons proliferate across allied navies.

Seabed Sentry

Seabed Sentry is Anduril’s modular, persistent seabed node designed for long duration undersea sensing and deterrence. It is explicitly architected for mass deployment, reusability, and multi-year operation.

Key characteristics:

Multi-year endurance without maintenance

Modular payloads

Scalable manufacturing

Rapid redeployment

Anduril has stated it will “soon begin producing Seabed Sentry at scale.” For this mission class, SeaPower is the only commercially available battery system that is simultaneously:

Pressure tolerant to 6,000m

Energy dense enough for multi-year missions

Logistically deployable at scale

Estimated Kraken revenue per node:

C$0-2M

Conservative production modeling:

2026: 250 nodes, C$25-30M

2027: 500 nodes, C$50-60M

Combined with Copperhead:

C$60-70M incremental revenue in 2026

C$140M+ in 2027

Mission applications include:

Critical undersea infrastructure protection

Chokepoint and harbor monitoring

Forward deployed deterrence

Distributed seabed ISR for NATO navies

European Market Positioning

Anduril has explicitly identified Europe as a priority theater for Seabed Sentry deployment. As stated by Rich Drake, Anduril’s GM for UK & Europe, the region’s varied depth, temperature, and salinity profiles are a strength, not a limitation.

Seabed Sentry is positioned as the backbone of a scalable NATO seabed surveillance layer, creating a structural outcome where:

Anduril provides the system-of-systems

Kraken becomes the de facto power standard for allied seabed defense

Lattice: The System That Ties It All Together

All of these platforms (Dive-LD, Ghost Shark, Copperhead, and Seabed Sentry) are orchestrated through Anduril’s Lattice software platform. Lattice fuses sensor data, command-and-control, and autonomous tasking into a single operational picture.

Kraken’s role is foundational:

SeaPower enables endurance

AquaPix® SAS enables perception

Lattice enables coordination, autonomy, and scale

This architecture creates a reinforcing loop: as Lattice drives higher autonomy and platform count, demand for Kraken’s power and sensing subsystems scales in parallel. Kraken is therefore not just a supplier to individual vehicles, but a critical enabler of Anduril’s entire undersea autonomy stack.

HII / Hydroid

HII is the legacy global leader in unmanned undersea vehicle (UUV) production and remains deeply embedded across US Navy and allied naval fleets. While Anduril represents the disruptive edge of autonomous undersea warfare, HII represents the installed base, procurement muscle memory, and long standing operational trust of incumbent naval programs. Kraken’s positioning across both creates a uniquely de-risked defense revenue profile.

Kraken’s sonar technology is integrated across multiple REMUS platforms, forming a material portion of Hydroid’s sensing stack.

REMUS 100 / 300 / MK18 / NGR

Kraken’s MP-SAS (man-portable synthetic aperture sonar) was selected for the REMUS 300 platform, which underpins the US Navy’s Lionfish Small UUV program. Lionfish is designed as a standardized, modular, and rapidly deployable small UUV for expeditionary and littoral operations.

Program documentation indicates:

~200 unit program target over five years

Follow on revenue from:

Depot level maintenance

Software upgrades

Sensor refresh cycles

Lifecycle support and spares

Estimated Kraken revenue per unit:

C$400k-700k

Operational use cases include:

Mine countermeasures (MCM)

Harbor clearance and port security

Rapid response survey missions

Forward deployed autonomy in contested littorals

Lionfish is strategically important because it establishes Kraken’s sonar as a baseline capability across a standardized Navy-wide small UUV architecture.

REMUS 620 & REMUS 6000

Kraken’s AquaPix® MIN-SAS-60 and MIN-SAS-120 are already integrated on larger REMUS variants, including REMUS 620 and REMUS 6000. These platforms represent the high end of the UUV spectrum, capable of long range and deep water missions.

Estimated Kraken revenue per vehicle:

C$500k-1.2M

These vehicles are used across:

Military ISR and seabed warfare missions

Government hydrographic and intelligence agencies

Offshore energy, subsea cable, and pipeline inspection

Scientific and deep ocean research

REMUS 6000 in particular is among the few operational AUVs capable of full ocean depth class missions, reinforcing Kraken’s credibility in the most demanding environments.

Strategic Meaning

HII now faces structural competitive pressure from Anduril’s vertically integrated, software defined autonomy model. If HII responds (as expected) by accelerating UUV output, modernizing sensor stacks, and increasing platform autonomy, Kraken stands to benefit disproportionately.

Kraken occupies a rare position:

Supplier to the disruptor (Anduril)

Supplier to the incumbent (HII / Hydroid)

In effect, Kraken becomes the common denominator across competing undersea autonomy ecosystems. This dual exposure:

Reduces single prime dependency risk

Increases program resilience across budget cycles

Positions Kraken as a default sensor provider regardless of which platform family dominates future fleet composition

From a portfolio construction standpoint, this makes Kraken one of the few small cap defense suppliers levered to both sides of the undersea autonomy transition, materially de-risking its medium and long term defense revenue pipeline.

Teledyne Marine

Teledyne Marine operates one of the largest global installed bases of commercial and defense unmanned underwater vehicles, spanning offshore energy, hydrography, and naval customers. While Teledyne is not positioned as a disruptive autonomy prime in the Anduril sense, its breadth of deployment makes it a critical channel for Kraken’s technology to propagate across mixed use fleets where commercial and defense requirements increasingly overlap.

Kraken supplies both sonar and power subsystems into key Teledyne platforms, reinforcing its role as a high end component supplier rather than a platform competitor.

Gavia

The Gavia AUV is widely deployed for coastal survey, mine countermeasures training, and maritime security missions. Kraken supplies:

AquaPix® MIN-SAS-60

Estimated Kraken revenue per system:

C$400-600k

Gavia’s strength lies in its modularity and ease of deployment, making it attractive to smaller navies, coast guards, and government agencies. Kraken’s integration here places its SAS technology into fleets that often act as entry points for countries beginning to adopt autonomous undersea capabilities.

SeaRaptor

The SeaRaptor platform sits at the higher end of Teledyne’s portfolio and supports more demanding missions in deeper water and harsher conditions. Kraken supplies:

AquaPix® MIN-SAS-120

SeaPower batteries

Estimated Kraken revenue per system:

C$1.3-1.7M

SeaRaptor is used for advanced hydrographic survey, infrastructure inspection, and defense adjacent missions where endurance and resolution matter. The combination of Kraken’s batteries and SAS on this platform reinforces Kraken’s positioning as a supplier of complete subsystems rather than single point components.

Strategic Meaning

Teledyne’s customer base spans commercial operators, government agencies, and defense users. Kraken’s presence across this installed base provides:

Broad international exposure without heavy customer concentration

Recurring upgrade and refresh opportunities as sensors evolve

A pathway from commercial adoption into defense procurement

This makes Teledyne an important stabilizing pillar in Kraken’s revenue mix, complementing higher growth defense primes with steady, global demand.

Kongsberg / Ocean Infinity

Kongsberg’s HUGIN family is widely regarded as the gold standard in offshore survey and naval inspection, particularly among European and NATO navies. Integration onto HUGIN platforms carries disproportionate signaling value: systems selected for HUGIN are often viewed as reference implementations for quality, reliability, and performance.

HUGIN Superior 6000

On the HUGIN Superior 6000, Kraken supplies:

SeaPower batteries

AquaPix® MIN-SAS

Estimated Kraken revenue contribution per system:

C$800k-1.2M

HUGIN Superior 6000 is designed for deep water survey, seabed warfare support, and high consequence inspection missions. It is frequently used by defense ministries, intelligence agencies, and offshore operators conducting the most demanding subsea work.

Strategic Meaning and Influence

Kongsberg’s influence extends beyond its own sales. As a long standing defense contractor and trusted supplier to European navies, Kongsberg plays a material role in shaping procurement preferences and technical standards across NATO.

Kraken’s integration into the HUGIN ecosystem therefore serves multiple strategic functions:

Validates Kraken’s technology against the most demanding legacy benchmarks

Builds credibility with conservative procurement bodies

Increases the probability of Kraken being specified by name in future tenders

Ocean Infinity’s use of HUGIN platforms further extends this exposure into large scale commercial and government backed seabed mapping projects, reinforcing Kraken’s relevance in both security and infrastructure driven missions.

Terradepth

Terradepth operates at the high end of commercial autonomous undersea operations, with a focus on long endurance, wide area seabed mapping and infrastructure inspection. Its AxV platform is designed for extended missions where endurance, data quality, and reliability are more critical than rapid redeployment.

The AxV long endurance AUV incorporates:

AquaPix® MIN-SAS

Estimated Kraken revenue per platform:

C$800k-1.2M

Terradepth’s operating model emphasizes persistent coverage over large geographic areas, often supporting government backed mapping initiatives, offshore energy development, and large scale seabed characterization projects. Kraken’s SAS integration on AxV reinforces its positioning in commercial missions that increasingly resemble defense ISR in scale and complexity, blurring the line between civil and security driven subsea operations.

Strategic Meaning

Terradepth strengthens Kraken’s exposure to:

Long duration autonomous missions outside traditional defense procurement

Customers that value endurance and data quality over platform count

Commercial programs with defense adjacent relevance (seabed mapping, infrastructure awareness)

This provides Kraken with incremental growth that is uncorrelated to defense budgets, while still benefiting from the same technological moat.

Rheinmetall / EUROATLAS

Rheinmetall represents one of Kraken’s most important European defense channels. The Greyshark AUV is positioned as a standardized, scalable autonomous system for European navies, aligning with NATO priorities around mine countermeasures, seabed surveillance, and distributed undersea operations.

Kraken supplies:

AquaPix® MIN-SAS

Estimated Kraken revenue per Greyshark:

C$500-750k

Crucially, Greyshark is not a speculative program. Production planning indicates:

150+ Greyshark units expected in 2026

Corresponding Kraken revenue of C$75-112.5M from this program alone

Mission Set and Strategic Importance

Greyshark is designed for:

Mine countermeasures (MCM)

Port and harbor security

Forward deployed ISR

Interoperable NATO operations across multiple navies

As a Rheinmetall backed platform, Greyshark benefits from Rheinmetall’s deep relationships with European defense ministries and procurement agencies. Kraken’s integration into this platform places its SAS technology at the center of European undersea modernization efforts, independent of US centric programs.

Strategic Meaning

The Rheinmetall / EUROATLAS relationship provides:

Large scale, near term European defense volume

Reduced reliance on any single prime or geography

Validation from one of Europe’s most conservative and influential defense contractors

Taken together with Anduril and HII, Greyshark reinforces Kraken’s role as a pan-Western standard for high resolution undersea sensing, spanning North America, Europe, and allied defense markets.

Cellula Robotics

Cellula Robotics is a specialist operator and platform developer focused on ultra long endurance UUV missions, particularly in Arctic and sub-Arctic environments where logistical access, recovery windows, and reliability constraints are extreme. These environments place unique demands on energy systems, making battery performance a primary gating factor rather than a secondary subsystem.

Kraken supplies SeaPower batteries for multiple Cellula platforms, including:

Envoy (battery variant)

Guardian (battery variant)

Estimated Kraken revenue contribution:

C$650k-2.0M per vehicle, depending on configuration and endurance requirements

Cellula’s platforms are designed for missions such as:

Arctic seabed mapping and surveillance

Under ice navigation and ISR

Long range autonomous patrol in remote regions

Persistent environmental and infrastructure monitoring

Strategic Meaning

Cellula reinforces Kraken’s exposure to defensible niche markets where performance requirements sharply limit viable competitors. Arctic operations are particularly unforgiving, and successful deployments in these environments serve as proof points for battery reliability, thermal performance, and system robustness. This further entrenches SeaPower as a trusted solution for extreme mission profiles that cannot tolerate failure.

Elta Systems

Elta Systems, a subsidiary of Israel Aerospace Industries (IAI), is a leading developer of ISR systems and autonomous platforms for defense and intelligence customers. Elta’s Blue Whale UUV is positioned as a large, multi-mission autonomous system optimized for intelligence gathering, seabed awareness, and maritime security.

The Blue Whale UUV integrates:

AquaPix® MIN-SAS

Estimated Kraken revenue per platform:

C$800k-1.2M

Blue Whale’s mission set includes:

Covert ISR

Subsea reconnaissance

Maritime domain awareness

Intelligence support for naval task groups

Strategic Meaning

Elta’s adoption of Kraken’s SAS technology is strategically important for two reasons. First, it validates Kraken’s sensing performance within a highly selective, security conscious defense ecosystem. Second, it expands Kraken’s footprint into Middle Eastern and allied ISR programs, further diversifying its defense exposure beyond North America and Europe.

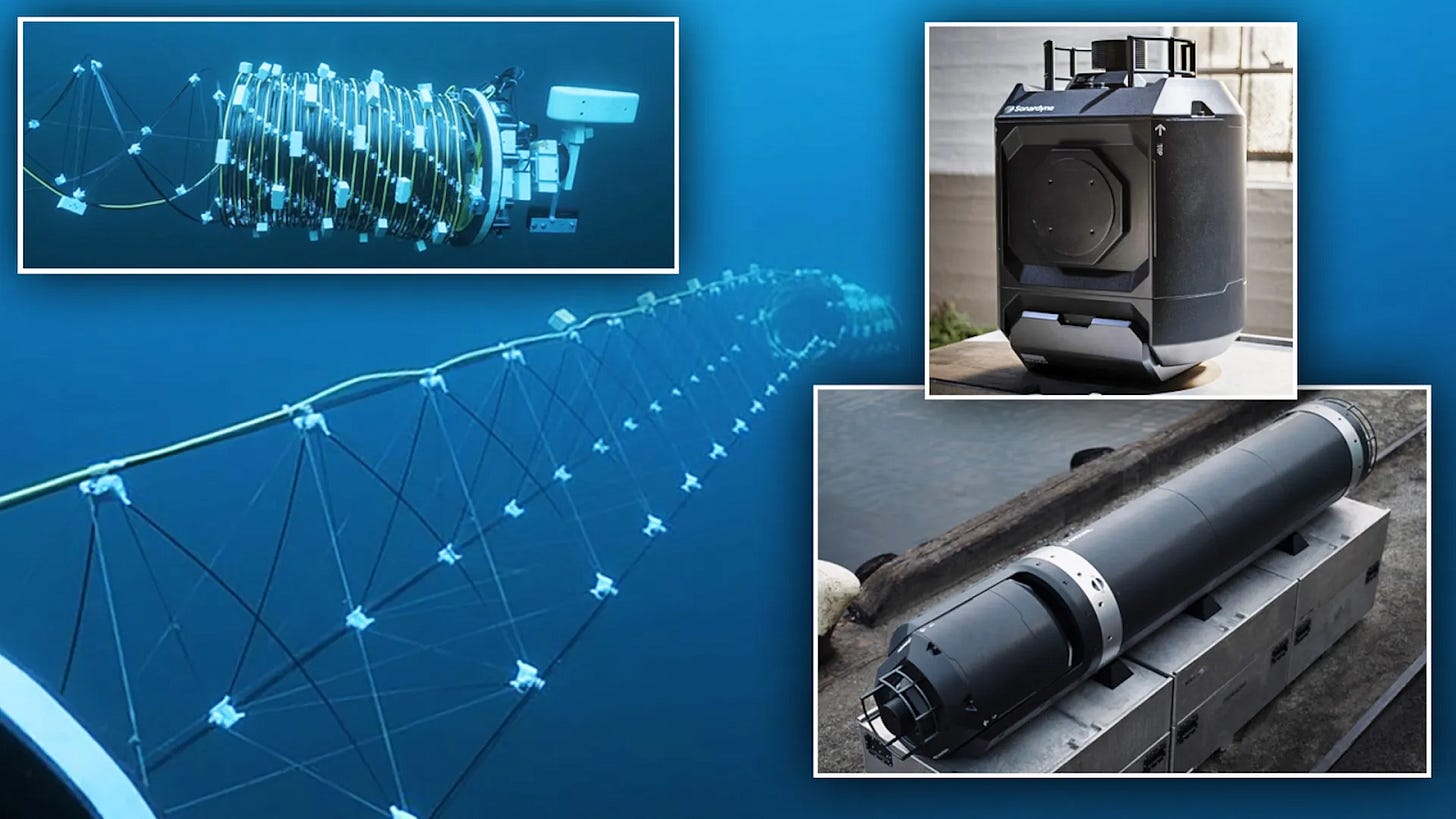

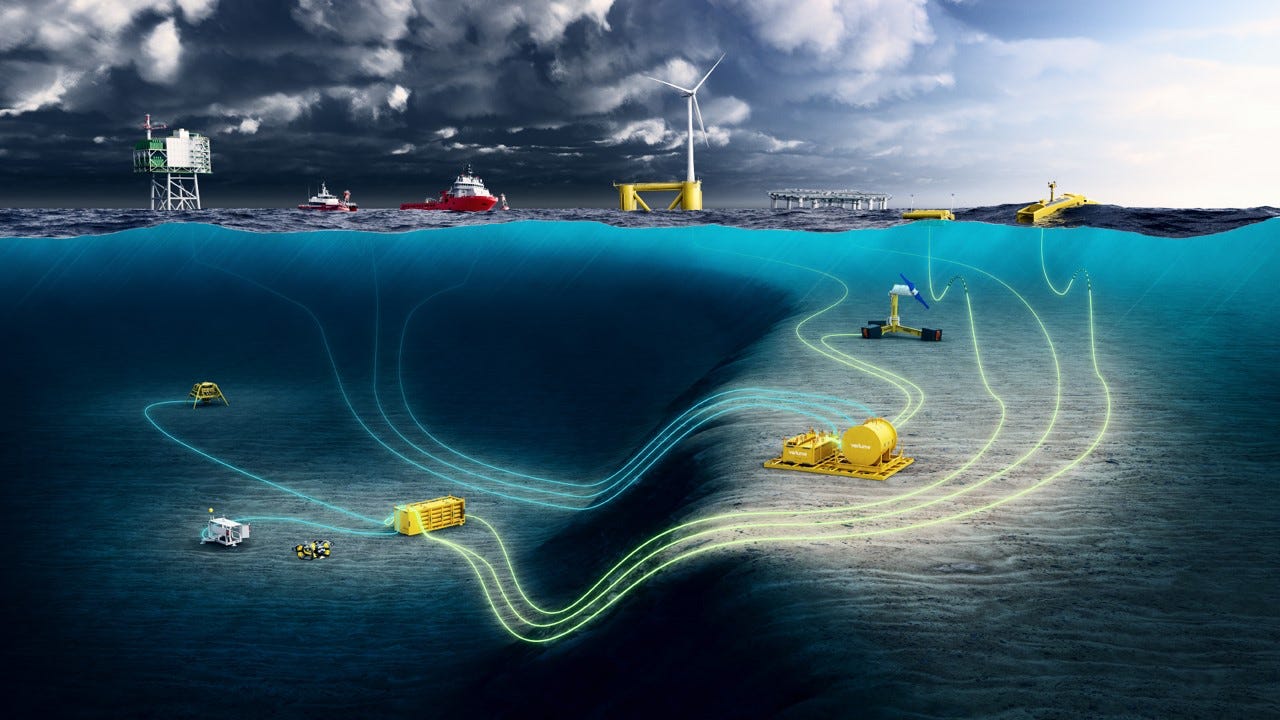

Verlume Partnership

The Verlume partnership is Kraken’s long duration, non-defense exponential curve.

Verlume provides:

CHARGE: compact recharge node

HALO: deep water (6000m) seabed battery

ORAH: shallow water high capacity system

AIRIES: autonomous AUV “garage”

Axonn®: energy management system

Kraken provides:

SeaPower batteries

Integration support

Data/power interface electronics

Revenue Optionality and Scale

Each AIRIES / HALO-class installation requires approximately 100-200 kWh of subsea energy storage.

At conservative pricing assumptions:

US$5-10k per kWh

US$500k-2.0M of Kraken battery revenue per station

Even modest adoption scenarios are meaningful:

20 North Sea wind farms deploying one system each implies US$40-100M of cumulative battery revenue

Global offshore wind expansion, encompassing hundreds of farms, supports a US$300M-1B+ long term opportunity

Strategic Meaning

Verlume establishes Kraken’s third major growth pillar, alongside:

Defense sonar systems

Defense batteries and autonomy platforms

Unlike defense, this market benefits from:

Multi-decade infrastructure investment cycles

Regulatory driven inspection and monitoring demand

Increasing adoption of resident AUV paradigms

As offshore energy operators shift from vessel based inspection to autonomous, permanently deployed systems, Kraken’s batteries become foundational infrastructure rather than episodic hardware sales.

3D at Depth

Kraken’s acquisition of 3D at Depth is strategically significant for reasons that extend well beyond the immediate financial contribution. While the business is profitable and high margin in its own right, its true value lies in the procurement infrastructure and regulatory positioning it brings into Kraken’s corporate structure.

A High Quality, Profitable Operating Business

3D at Depth is a mature subsea LiDAR and dimensional control provider with a long operating history across defense, energy, nuclear, and infrastructure markets.

Key operating metrics (2024, unaudited US GAAP):

US$14M in revenue

US$8.4M gross profit (~60% gross margin)

US$1.1M operating income

Operational footprint:

56 employees

Operations in the United States and United Kingdom

450+ completed projects

60+ global clients

25+ master service agreements

End markets include offshore energy, nuclear facilities, hydroelectric infrastructure, defense installations, and marine science. This provides Kraken with an immediately accretive revenue stream while preserving margin discipline consistent with Kraken’s broader technology portfolio.

A Structural Gateway into US Defense Procurement

The more consequential aspect of the acquisition is structural rather than financial. Through 3D at Depth, Kraken now possesses a fully embedded US defense contracting platform.

3D at Depth provides:

A US incorporated, ITAR compliant operating entity

An active GSA schedule

Established past performance within US government and defense programs

Domestic supplier status for Department of Defense procurement

Eligibility for US only RFIs and RFPs

A contracting structure that is prime friendly for teaming with Lockheed, RTX, Boeing, and other Tier 1 defense contractors

These attributes are not easily replicated. For non-US companies, access to US defense procurement is often limited by foreign ownership restrictions, ITAR constraints, and a lack of domestic contracting history. 3D at Depth bypasses these barriers entirely.

Strategic Implications for Kraken

The acquisition effectively functions as a Trojan Horse into the US defense procurement system. Kraken did not merely acquire technology, it acquired:

Regulatory access

Contracting credibility

Bid eligibility that would otherwise take years to establish organically

This dramatically shortens the timeline for Kraken’s broader technology stack (SeaPower batteries, SAS, seabed systems, and future autonomous platforms) to be specified, integrated, and contracted within US programs.

Combined with Kraken’s expanding defense relationships and board level expertise in US procurement, 3D at Depth provides the infrastructure layer required to convert technical advantage into scaled US defense revenue.

Data Monetization & Subsea Intelligence

Beyond hardware, services, and platform integration, Kraken is quietly building one of the most valuable long term assets in the undersea domain: proprietary, high resolution subsea data accumulated across defense, energy, and civil infrastructure missions.

Every SeaPower enabled UUV, every AquaPix® SAS mission, every KATFISH tow, every LiDAR scan generates dense, georeferenced datasets that are exceptionally difficult to replicate.

Unlike surface ISR or space based sensing, subsea data benefits from extreme scarcity. Large portions of the ocean floor (particularly around critical infrastructure, choke points, and contested regions) are either poorly mapped or mapped at resolutions that are operationally insufficient. Kraken’s systems routinely capture centimeter scale SAS imagery, sub-bottom profiles, and engineering grade LiDAR point clouds that reveal changes over time, object movement, burial depth, and structural degradation.

Over time, this creates optionality for monetization that does not require Kraken to become a prime contractor or classified intelligence provider. Several natural pathways exist:

Change detection and time series analytics

Repeated SAS, SBI, and LiDAR surveys enable longitudinal monitoring of seabed conditions, cables, pipelines, ports, and maritime approaches. Customers increasingly care less about raw imagery and more about what changed, creating demand for subscription based analytics, alerts, and risk scoring.Digital twins and asset lifecycle intelligence

Kraken already produces engineering grade digital twins for offshore energy and nuclear clients through 3D at Depth. Extending this capability to persistent subsea assets (pipelines, wind farms, ports, seabed nodes) creates recurring data refresh and validation revenue layered on top of existing surveys.Autonomy training datasets

High quality labeled subsea imagery is a bottleneck for autonomy. Kraken’s SAS and LiDAR datasets are uniquely valuable for training navigation, obstacle avoidance, mine classification, and object recognition models used by primes and navies. This data has intrinsic value even without Kraken operating the vehicles.Government and allied data licensing

Navies and infrastructure agencies increasingly seek shared situational awareness without duplicating surveys. Kraken’s position across multiple platforms and operators creates the possibility of non-exclusive data licensing or cost sharing arrangements, particularly in allied environments.

Importantly, Kraken does not need to monetize this data aggressively or immediately for the thesis to work. The optionality itself matters. The company already controls the sensors, the power systems, the integration layer, and (through RaaS and survey operations) the collection pipeline. As undersea operations scale from dozens to thousands of autonomous assets, the value of normalized, high resolution subsea data compounds.

This creates a long dated, high margin upside vector that is not currently reflected in models or valuation multiples, and which would sit naturally alongside Kraken’s existing hardware, services, and recurring inspection businesses rather than replacing them.

Geopolitics and Demand Inevitability

The macro setup is increasingly deterministic. China has translated industrial policy into maritime mass: it dominates global commercial shipbuilding and operates a large dual use shipyard base, giving it an ability to surge naval adjacent production capacity in ways the West cannot easily match on timelines measured in months rather than decades. CSIS summarizes the industrial gap starkly, noting that China’s shipbuilding output and scale have eclipsed the US to a degree that is strategically consequential beyond commercial markets.

The US and allies are responding, but they are responding rationally: rather than trying to win a ship for ship competition, they are building an economically asymmetric undersea layer. Autonomous systems that can be fielded quickly, deployed in volume, and distributed across chokepoints, seabed infrastructure, and contested littorals. This is exactly the logic behind programs like Replicator and modernization initiatives that prioritize autonomy, mass manufacturability, and accelerated acquisition.

NATO, Canada, and Allied Spending

Defense spending is no longer discretionary “cycle spending” across Kraken’s key customers; it is being formalized into GDP linked commitments that persist across election cycles because they are tied to NATO capability targets and the credibility of collective deterrence.

NATO’s long standing benchmark has been 2% of GDP, and NATO reporting indicates broad convergence toward that level across the alliance, with the trajectory still rising.

At the 2025 NATO Summit in The Hague, Allies went further, committing to a 5% of GDP investment concept by 2035 (with at least 3.5% defined as core defense expenditure under NATO definitions).

The United Kingdom has publicly pledged a path to 2.5% of GDP by 2027, with internal defense leadership pushing for higher targets over time.

Canada has accelerated its timetable to reach 2% of GDP by early 2026, reinforced by both reporting and public government statements.

For Kraken, this matters because its platform partners and prime channels (Ex: Anduril, Rheinmetall/EUROATLAS, Kongsberg linked ecosystems, and US primes enabled through Kraken’s US footprint) sit directly under these allied recapitalization umbrellas. In practice, these GDP targets are not abstract, they translate into procurement categories Kraken is already exposed to: mine countermeasures, seabed surveillance, autonomous ISR, critical infrastructure protection, and undersea weapons.

Why the Undersea Layer Is the Western Answer

The undersea domain is where deterrence is cheapest per dollar spent, and where autonomous systems offer the largest marginal advantage. Distributed seabed nodes, large displacement AUVs, and attritable undersea weapons create persistent presence without the operating cost, training pipeline, and vulnerability of crewed platforms.

That is why the combination of Ghost Shark class XL-AUVs, Dive-LD fleets, Copperhead class autonomous weapons, and Seabed Sentry nodes is strategically coherent: together they create a scalable subsea mesh that can monitor, deny, and (if necessary) strike at a cost curve that does not require matching China’s shipyard throughput.

Why Anduril Is Central: Scale Manufacturing + Autonomy Economics

This is where Anduril’s approach becomes uniquely relevant. The West’s constraint is not concept, it’s scale. Anduril’s model is explicitly designed to field autonomy at production rates that legacy primes struggle to reach quickly.

Copperhead is the clearest example of the economic asymmetry: Anduril has stated its production system targets “very high hundreds to thousands” of units per year, order(s) of magnitude above traditional torpedo production norms. Turning undersea lethality into a volume manufacturing problem rather than an artisanal defense industrial problem.

In that framework, Kraken’s role becomes strategically embedded rather than merely commercial. SeaPower enables endurance and power density in deep water and pressure tolerant form factors, AquaPix SAS enables perception and classification, and the enabling subsystems become the quiet bottleneck inputs that scale with every additional hull, node, or weapon produced.

Project 33

The strategic intent of modernization initiatives is directly aligned with Kraken’s niche positioning. The stated objectives are highly congruent with Kraken’s product stack:

Eliminating maintenance driven readiness gaps through more reliable, modular systems

Scaling robotic/autonomous systems as force multipliers

Compressing acquisition timelines from decades to years

Expanding persistent undersea sensing and strike options

Hardening seabed infrastructure and undersea communications

The important takeaway is that undersea autonomy is no longer a “nice to have modernization effort.” It is the only feasible route to maintaining parity under Western industrial constraints, and this is precisely the environment in which Kraken’s batteries and high end sonar become non-substitutable components of the allied response.

Tariff Exposure and Supply Chain Protection

A key risk for industrial and hardware centric defense suppliers is exposure to tariffs, customs duties, and trade disruptions. Kraken’s largest and most strategically important revenue streams are structurally insulated from this risk.

Kraken’s subsystems supplied into Anduril programs (Dive-LD, Ghost Shark, Copperhead, Seabed Sentry) fall under DFARS 252.225-7013, which the US Department of Defense has confirmed covers both tariffs and customs duties. In simple terms, this means Kraken’s content embedded in Anduril platforms is effectively tariff exempt for US defense procurement. This materially reduces margin risk, pricing friction, and delivery uncertainty as volumes scale.

Beyond Anduril, Kraken benefits from a broader compliance and localization advantage:

The acquisition of 3D at Depth provides a US incorporated, ITAR compliant operating entity.

Kraken already supplies NATO navies, US primes, and allied defense programs where domestic or allied sourcing is favored.

Subsea batteries, SAS, and sensing systems are treated as mission critical defense subsystems, not discretionary imports, lowering the probability of punitive trade action even outside DFARS protected contracts.

While purely commercial offshore energy projects may not enjoy the same formal exemptions, Kraken’s products in these markets tend to be specified based on performance, certification, and operational risk reduction rather than lowest cost sourcing. This limits practical tariff pass through risk relative to commoditized hardware suppliers.

Bear Market and Defense Spending Resilience

A broader equity market downturn represents a valuation risk, but not a thesis breaking operational risk for Kraken.

Defense procurement, particularly in undersea warfare, autonomy, and critical infrastructure protection, has historically shown low cyclicality relative to the broader economy. Current demand is driven by:

Multi-year defense programs already funded or contractually awarded

Explicit government mandates

Structural shifts toward autonomous systems as cost effective force multipliers

Kraken’s revenue is tied to program execution and platform deployment, not discretionary enterprise spending. Even in risk off or recessionary environments, governments tend to preserve or accelerate defense spending perceived as strategically asymmetric or deterrence critical.

Importantly, Kraken is positioned at the subsystem level, not the platform or prime level. This makes its revenue:

Less exposed to program cancellations

More diversified across customers and platforms

Harder to cut without impairing the underlying system

In a bear market scenario, Kraken may experience multiple compression alongside peers, but the flow of contracts, deliveries, and cash generation is likely to remain intact, providing a fundamental floor under the business while preserving upside when risk appetite returns.

Risks and Competitive Landscape

Execution Risk: Scaling to Meet Demand

The primary operational risk for Kraken is not demand, but execution at scale. Multiple programs across Anduril, HII, European primes, and offshore energy are transitioning from prototype or early production into serial manufacturing over the next 24-48 months. This creates near term pressure on manufacturing throughput, supplier coordination, and quality control.

That said, Kraken enters this phase unusually well prepared. The Halifax battery facility was built for SeaPower scale up, production is modular rather than bespoke, and Kraken’s role as a subsystem supplier (rather than a full platform OEM) materially reduces integration and logistics complexity. Importantly, Kraken’s products are already qualified, embedded, and specified by primes, meaning scaling is largely a manufacturing and scheduling challenge rather than a technology or certification risk.

Competitive Landscape: SeaPower Batteries

Competition in subsea energy storage exists, but it is structurally constrained.

Incumbent alternatives (Saft / TotalEnergies, SubCtech, SWE, DeepSea Power & Light) rely primarily on:

Oil compensated steel canisters

Titanium pressure vessels

Gel filled pressure-compensated designs

These approaches work, but they impose unavoidable tradeoffs:

Lower effective energy density at depth

Higher mass and volume penalties

More mechanical failure modes

Higher system level integration cost

SeaPower’s pressure tolerant, polymer encapsulation architecture is fundamentally different. It removes the pressure vessel entirely, which is why Kraken consistently leads on Wh/kg, Wh/L, and deployable depth in benchmarking analyses. Replicating this is not a matter of incremental engineering, it requires years of materials science iteration, pressure testing, certification, and customer trust building.

As a result, SeaPower is frequently sole sourced or specified by name in defense programs, limiting true price based competition.

Competitive Landscape: Synthetic Aperture Sonar (SAS)

High resolution SAS is a narrow field, and Kraken sits at the top end of it.

Large defense primes (L3Harris, Thales, Atlas Elektronik) and niche players offer sonar solutions, but most fall into one of two categories:

Conventional side scan or interferometric sonar with resolution decay at range

SAS systems optimized for narrow mission sets or specific platforms

Kraken’s differentiation is system level:

Constant ~3cm x 3cm resolution across the swath

Simultaneous imaging and bathymetry

Modular deployment across UUVs, tow bodies (KATFISH), and future circular SAS configurations

Real time processing that supports autonomy and ATR

Once integrated, SAS switching costs are high. Vehicle dynamics, autonomy software, data pipelines, and operator workflows become tightly coupled to the sensor. This is why Kraken’s SAS persists across platforms and primes, and why competitive displacement risk is materially lower than in commoditized sensing categories.

Strategic Risk Assessment

Taken together, Kraken’s risk profile is asymmetric:

Downside risks are primarily operational (pace of scaling, delivery timing), not existential or technological.

Competitive risks are muted by deep moats, qualification barriers, and embedded program positions.

Market risks (budget cycles, macro volatility) are partially offset by defense spending resilience and Kraken’s role at the subsystem level, where cuts are harder to make without impairing platform capability.

The result is a company whose main challenge is executing on success rather than proving relevance, a materially different risk profile from early stage defense or autonomy peers.

Potential Acquisition Target

The core growth thesis does not rely on a corporate takeover, but Kraken’s strategic positioning makes acquisition a credible, asymmetric upside. The company sits at a rare intersection of pressure tolerant subsea energy storage, high resolution synthetic aperture sonar, and ITAR compliant procurement access, a combination that is difficult to replicate organically and time consuming to build internally.

Kraken’s technologies occupy bottleneck layers rather than platform layers. This distinction matters: primes and fast scaling defense entrants can build vehicles, autonomy stacks, and command-and-control software, but pressure tolerant batteries at 6,000m depth and high end SAS arrays remain specialist capabilities with long development cycles, qualification risk, and limited global suppliers. As undersea warfare and autonomous maritime systems scale from dozens to hundreds (and eventually thousands) of units, control over these bottlenecks becomes strategically valuable.

From a buyer’s perspective, Kraken offers three attributes that materially lower acquisition friction. First, its products are already embedded across multiple Western defense programs, reducing integration risk. Second, the acquisition of 3D at Depth provides a US based, ITAR compliant operating entity with established defense contracting credentials, enabling immediate participation in restricted procurement channels. Third, Kraken’s capital intensity remains low relative to the strategic value of its technology, making outright acquisition economically rational versus long term supplier dependency.

Potential acquirers span both incumbents and disruptors. Traditional defence primes (Ex: Lockheed Martin, RTX, Northrop Grumman, BAE Systems) face growing pressure to accelerate autonomous undersea capabilities, while newer entrants such as Anduril may eventually view vertical integration as a means to secure supply, protect margins, and control delivery timelines at scale. In either case, any credible near term acquisition would likely occur at a substantial premium given Kraken’s scarcity value, embedded program exposure, and the cost and time required to recreate its technology stack independently.

Importantly, this acquisition optionality should be viewed as upside rather than a base case assumption. Kraken’s standalone growth trajectory, driven by Anduril, HII, and broader NATO adoption already supports the investment thesis. M&A simply represents an asymmetric outcome layered on top of a fundamentally strong operating story.

Management and Board

Kraken’s management team and board reflect a deliberate shift from a niche subsea technology company toward a scaled, defense aligned infrastructure supplier. The composition matters because Kraken’s next phase is not about invention risk, but about manufacturing scale, program execution, and navigating allied defense procurement systems.

Executive Leadership

The company is led by Greg Reid (President & CEO), who has overseen Kraken’s transition from a project based sonar company into a multi-pillar defense and subsea infrastructure supplier. Under his tenure, Kraken has expanded from single product sonar offerings into pressure tolerant energy systems, recurring services, and US based operations through the acquisition of 3D at Depth. Reid’s leadership has been marked by disciplined capital allocation, conservative balance sheet management, and a clear bias toward technologies that become specified components inside larger prime led programs.

Financial execution is led by Joseph MacKay (CFO), whose role has been critical as Kraken moves into sustained profitability and higher volume defense programs. The financial organization has demonstrated improving operating leverage, expanding margins, and prudent capital raises timed to capacity expansion rather than balance sheet repair.

On the technical side, David Shea (EVP & CTO) anchors Kraken’s product roadmap across batteries, sonar, sub-bottom imaging, and LiDAR. His team has consistently delivered technologies that are not just best in class on paper, but ruggedized, certified, and accepted by navies and prime contractors. A key distinction in defense markets where theoretical performance is irrelevant without operational validation.

Operational scale is managed by Nat Spencer (EVP & COO), whose focus is manufacturing readiness, supply chain reliability, and program delivery. As Kraken ramps battery output, sonar integration, and multi-year defense contracts, this operational discipline is increasingly central to meeting demand without compromising margins or delivery timelines.

Board of Directors

Kraken’s board is structured to support credibility with primes, navies, and US procurement authorities.

The board is chaired by Peter A. Hunter, a seasoned subsea and defense operator with deep familiarity in autonomous underwater systems and capital markets. His background aligns closely with Kraken’s customer base and long cycle defense programs, providing continuity between strategy and execution.

A particularly important addition is Kristin Robertson, a defense industry veteran with over three decades of experience at Boeing and RTX. Notably, she previously led Boeing’s Orca XLUUV program, giving her direct insight into the very class of platforms Kraken now supplies through Anduril, HII, and allied programs. Her presence materially strengthens Kraken’s credibility with US primes and defense buyers, and provides institutional knowledge of how large scale UUV programs are evaluated, funded, and sustained.

The board also includes Kim Butler (CPA, ICD.D), who brings financial governance, audit, and capital markets expertise. This is increasingly relevant as Kraken transitions toward larger institutional ownership, potential uplistings, and higher disclosure expectations.

Additional directors such as Michael J. Connor and Michael McEwan contribute operational, commercial, and governance experience, reinforcing board oversight as Kraken scales across multiple jurisdictions and customer types.

Strategic Implications

Collectively, Kraken’s management and board signal a company that is past the invention stage and into the execution phase. This team is aligned around:

Scaling manufacturing without over capitalization

Navigating ITAR, NATO, and allied procurement frameworks

Managing multi-year, multi-customer defense programs

Maintaining capital discipline while funding growth

This governance structure meaningfully reduces execution risk as Kraken moves deeper into the defense industrial base and supports the broader thesis that Kraken is evolving from a Canadian technology supplier into a strategically relevant node in allied undersea infrastructure.

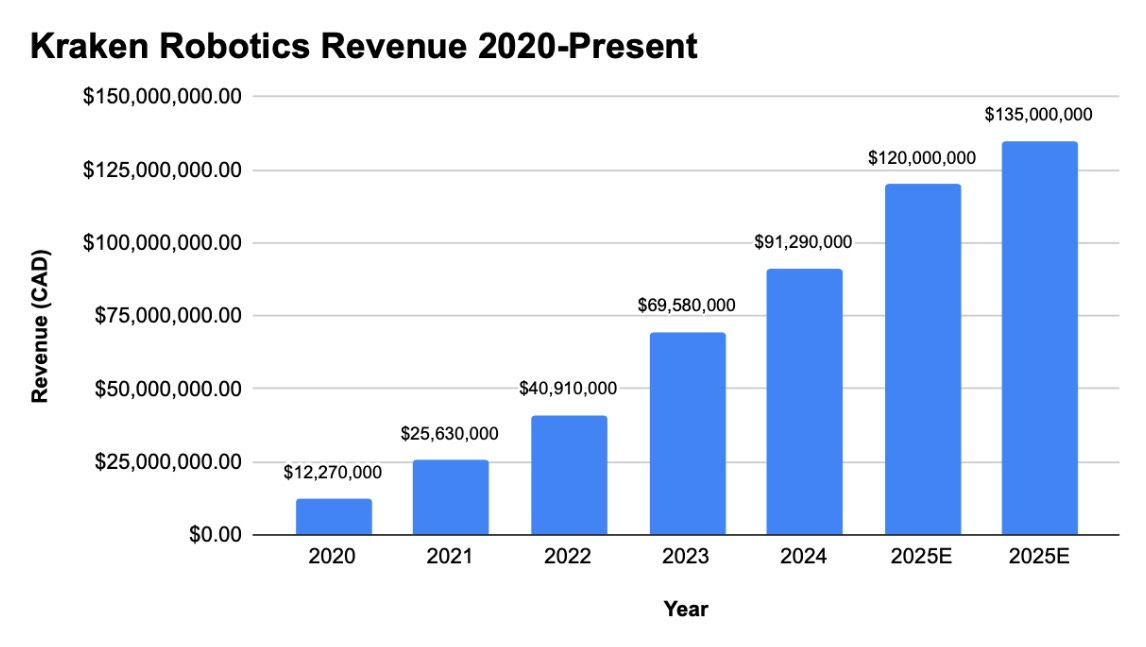

Financial Profile and Execution

Kraken is no longer a “story stock”, and its financial trajectory reflects that reality:

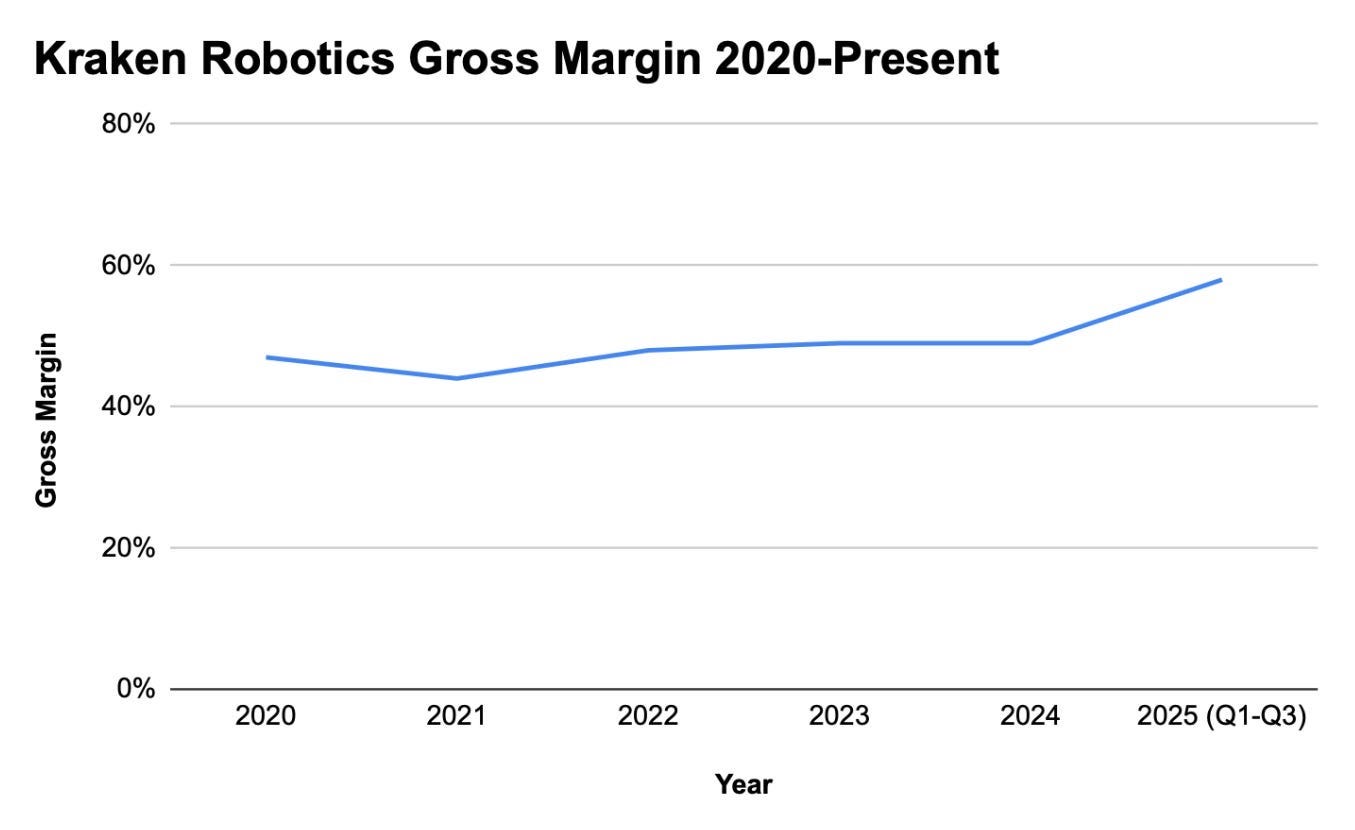

Revenue grew from C$12.27m (2020) to C$91.3m (2024), with management guiding C$120M-C$135M for 2025. Hitting C$120M alone leaves Kraken with a ~58% CAGR (2020-2025E low end).

Over 2020-2024 Kraken has:

Scaled revenue ~7.4x (C$12.3m to C$91.3m)

While holding gross margin within 40-50% and growing

The acquisition of 3D at Depth also adds a business with ~60% gross margins and positive operating income, immediately lifting consolidated margin profile.

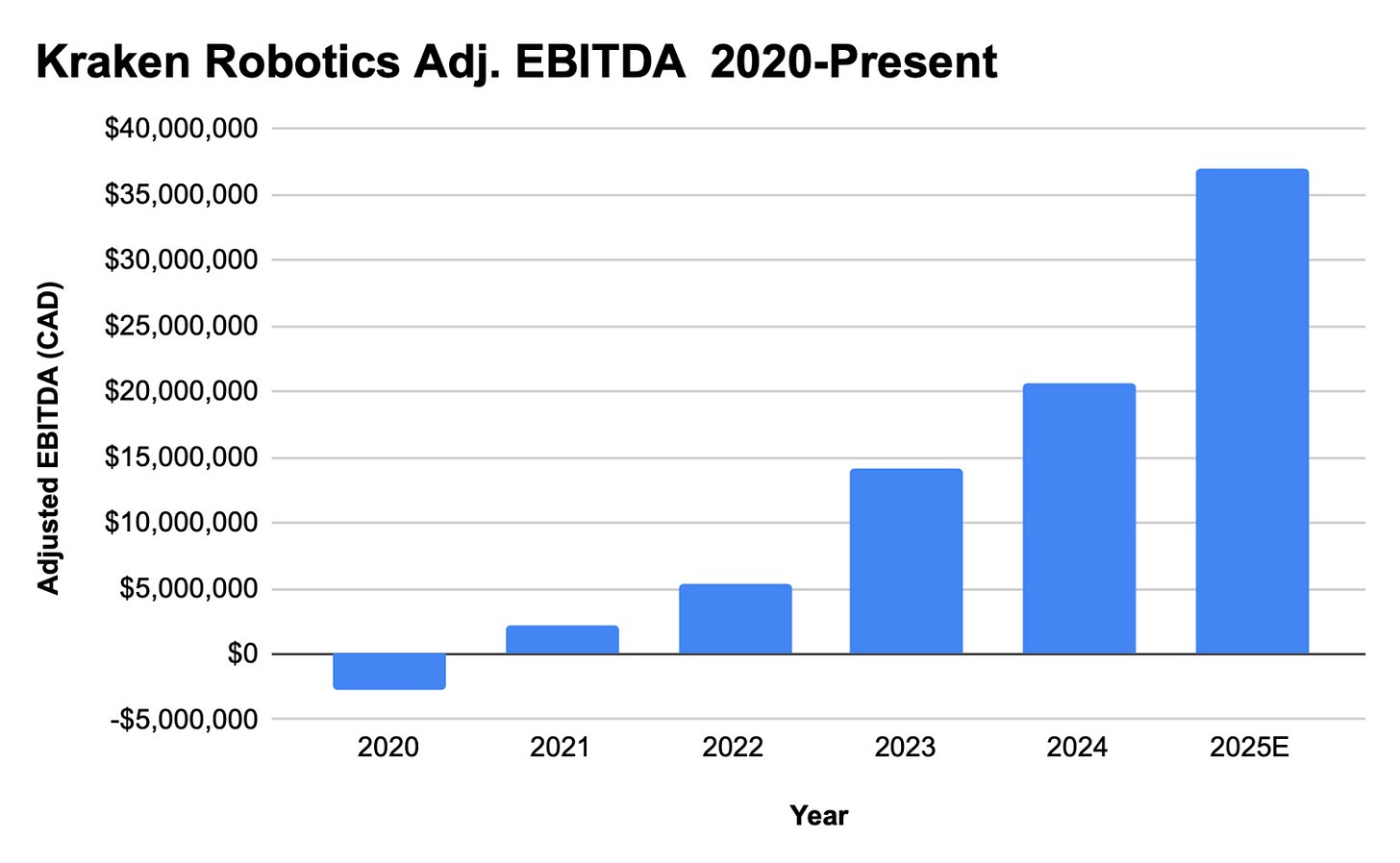

Kraken moved from negative EBITDA in 2020 to strong, scaling EBITDA by 2023-2024:

EBITDA 2020-2024: ~96% CAGR

EBITDA grew nearly 10x from 2021-2024

A conservative base case estimate for 2025 implies approximately C$37m of EBITDA, assuming:

Revenue of ~C$128m

Gross margin of ~58%

Operating expenses of ~C$37m

At this level, Kraken would be delivering:

~80% YoY EBITDA growth

EBITDA margins in the mid 20s to low 30s percent range

The highest profitability in the company’s history

Clear evidence of operating leverage

Capital Strategy and Capacity to Fund Growth

A critical but under appreciated aspect of Kraken’s investment profile is that its growth trajectory does not require heavy balance sheet risk or continuous dilutive capital raises. The company’s core businesses (SeaPower batteries, sonar systems, and software enabled services) are fundamentally capital light relative to the revenue they unlock.

Kraken’s recent and planned capital expenditures are targeted almost entirely at scaling bottleneck manufacturing steps, not building asset heavy platforms. The Halifax battery facility is the clearest example: a modest upfront investment enables output capacity that supports hundreds of millions of dollars of annual revenue at full utilization. The economics are asymmetric, incremental capex buys optionality, not fixed overhead.

Key characteristics of Kraken’s capital profile include:

Low fixed capital intensity:

SeaPower battery production does not require gigafactory style infrastructure. Pressure tolerant polymer encapsulation, module assembly, and testing scale linearly without massive tooling or real estate commitments.Modular capacity expansion: